Increasing vehicle emissions and awareness of environmental sustainability have led countries to implement stringent vehicular emission norms. To comply with these regulations, exhaust systems and after-treatment technologies reduce pollution from vehicle tailpipes. With the introduction of updated emission regulations, the newer after-treatment devices such as diesel oxidation catalysts, diesel/gasoline particulate filters, selective catalytic reduction, ammonia slip catalysts, electrically heated catalysts, exhaust gas recirculation systems, and lean Nox traps are equipped with new vehicles. With newer After-treatment devices installed in diesel engines are diesel particulate filters (DPF), diesel oxidation catalysts (DOC), lean NOx trap (LNT), and selective catalytic converters (SCR); and for gasoline engines include gasoline particulate filters (GPF).

For on-road vehicles, Europe follows the most stringent regulations concerning vehicular emissions. Euro 6 is the ongoing emission regulation established by the European Union directive to reduce harmful gases like carbon monoxide (CO), nitrogen oxide (NOx), hydrocarbons, and others from a vehicle’s exhaust system. In the Euro 6 standards, NOx limit is 84% lower than the Euro 3 level and DOC helps reduce the NOx, CO, and HC emissions by 42.0%, 38.5%, and 1.73%, respectively. Most other countries follow Euro standards such as Euro 5 and Euro 6. The US follows Tier 3 regulations for the light duty vehicle segment. Emerging economies with rising vehicle production like China which implemented China 6 emission regulation and India introduced new standards of BS 6 emission standards on April 1, 2020, which is equivalent to Euro 6. Countries from other parts of the world that are adhering to the Paris Agreement for a reduction in vehicle emissions are planning to introduce more stringent emission regulations. Countries such as Brazil, Russia, and South Africa are planning to introduce emission regulations like Euro 5 and Euro 6 post-2023. This will result in more emission stringency and a reduction in vehicle weight. Manufacturers are shifting toward exhaust after-treatment devices through advanced components and technologies to comply with emission standards. Thus, this is expected to fuel the demand for exhaust systems in on-highway vehicles.

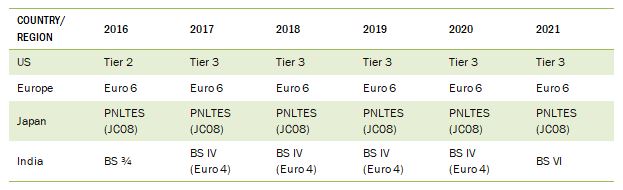

TABLE 1 historic overview of ON-ROAD VEHICLE EMISSION REGULATIONs For passenger vehicles, 2016–2021

To meet the regulatory requirement, OEMs are needed to install after-treatment devices like diesel particulate filters (DPF), diesel oxidation catalysts (DOC), exhaust gas recirculation (EGR), and other emission control devices are used as a catalytic converters in automotive exhaust systems to transform all harmful and toxic gases from engines into less harmful pollutants will also drive the exhaust system market parallelly.

The current emission regulation that is being followed in India is the Bharat Stage VI, an adapted version of the Euro VI regulation, which limits CO emission for passenger cars, HCVs, and two and three-wheelers. Furthermore, a more stringent BS6 Stage 2 is expected to be implemented in April 2023, which will mandate that BS6 Stage 2 compliant cars meet the emission norms in real-world driving conditions as well. Similarly, Europe proposed Euro 7 Regulation lately, which monitors tailgate and other vehicular emissions from the tires and brakes. According to MarketsandMarkets analysis, the global exhaust system market will grow by USD 47.9 billion by 2026 at a CAGR of 5.3% during the forecasted period.

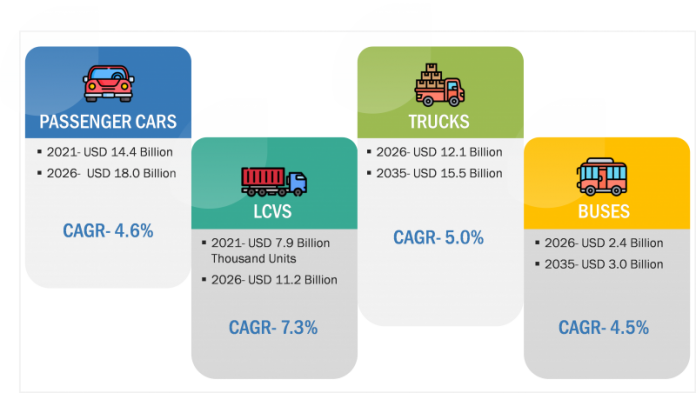

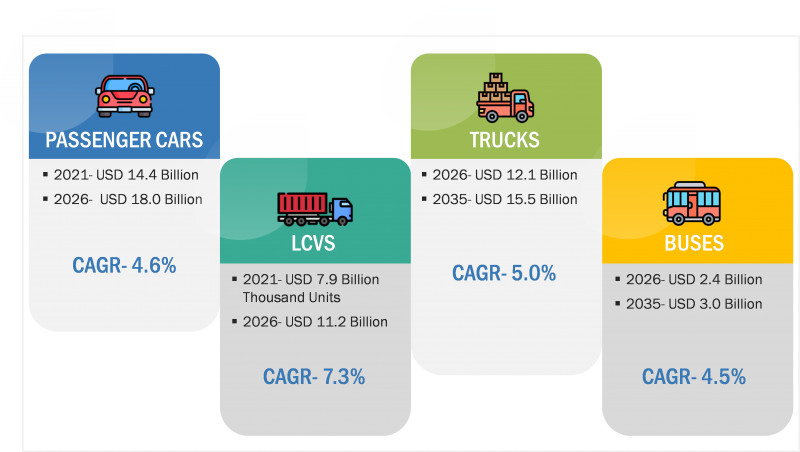

FIGURE 1 EXHAUST SYSTEM (OE) MARKET, BY ICE VEHICLE TYPE (USD Billion)

1.1.1 CLASS D AND ABOVE PASSENGER VEHICLES DEMONSTRATE STRONG DEMANDDOC and DPF are assumed to have 100% installation rates in Europe, the US, Japan, South Korea, and Canada for all diesel vehicle types—passenger cars, LCVs, trucks, and buses. This penetration is driven by ongoing emission norms such as Euro 6 and EPA 10. These standards have made installing DOC and DPF in diesel engines mandatory. Class D, E, and F diesel passenger vehicles in Europe and North America are mostly fitted with SCR technology, as diesel engines with more than two liters are mostly equipped with SCRs.

Heavy commercial vehicles, including trucks and buses, are not equipped with LNT devices due to large-capacity engines’ limited benefits. In the US and Canada, SCR has been employed in medium and heavy-duty vehicles since 2007, and this technology requires DEF (32.5% urea) to reduce NOx emissions. In 2010, the Environment Protection Agency (EPA) implemented regulations, which led to the increased application of SCR in the trucks segment. Until August 2014, all new medium- and heavy-duty trucks and buses in North America had installed SCR. Increased adoption of SCR has led to a rise in demand for DEF, as the dosage of DEF is approximately 3-5% of diesel consumption.

1.1.2 OFF-RAOD VEHICLES CAN BE A PROMISING MARKET FOR EXHAUST SYSTEM SUPPLIERS

Considering the increase in global demand for off-highway equipment, controlling Greenhouse Gas (GHG) emissions from vehicles and equipment has become a major challenge. Almost all developed countries have established programs/norms to deal with GHG emissions in the transportation industry. Most countries follow Euro standards such as stage V. The PM limit of the Stage V standard is 97% lower than that of Stage I, and the hydrocarbon (HC) + nitrogen oxides (NOx) limit is 94% lower. Countries following the Euro standards include Brazil, Russia, and South Africa. Exhaust after-treatment devices play a significant role in meeting these standards as it improves fuel economy. These heavy machines are mainly equipped with DPF and SCR to reduce harmful exhaust gases as these vehicles are equipped with heavy engines.

Exhaust system manufacturers and OEMs need to continuously manufacture emission exhaust after-treatment devices and components for off-highway equipment to adhere to emission regulations set by governments

1.2 UPCOMING & SPECULATED EMISSION REGULATIONS

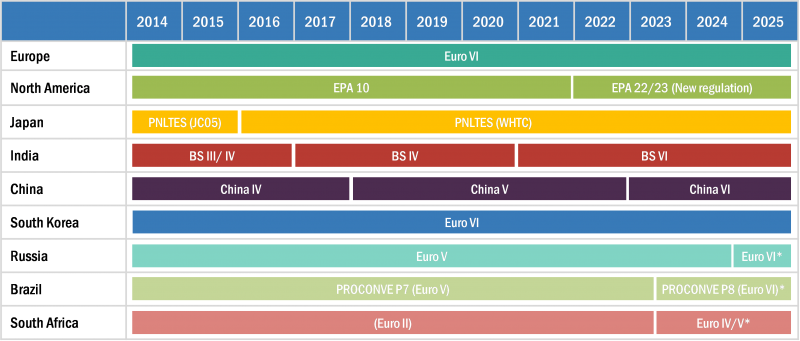

FIGURE 1 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK, 2014–2025

Source: European Commission, EPA, Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

Regulatory bodies are constantly upgrading environmental laws to curb carbon emissions. For instance, in India, BS-VI stage 2 norms are implemented from April 1, 2023, onwards, which require Real Driving Emissions (RDE) test to measure the pollutant level of hydrocarbons. This needs On-board Diagnostics (OBD2) to be installed standard. To comply with the regulation, the powertrains must be upgraded and equipped with an onboard self-diagnostic device, which monitors various factors, including changing driving behavior and real-time traffic conditions.

Further, Euro 7 standards will be adopted by the European Commission for all motors, such as cars, buses, vans, and lorries, from July 1, 2025, targeting zero carbon emission. The Euro 7 regulation includes various real driving emissions (RDE), including the emissions from the brakes and tires of ICE and EVs. In-depth emission monitoring from different vehicular systems is required to achieve the agenda. The commission has proposed that there will be a 45% reduction in CO2 from 2030 in the HCVs followed by 65% emission reductions from 2035 and a 90% emissions reduction from 2040 when compared with the 2019 emission levels. It is also proposed that by 2035, the Euro 7 will lower the total NOx emissions from cars and vans by 35% compared to Euro 6, and by 56% compared to Euro VI from buses and lorries, which would aid the net zero emission targets of 2050. However, it demands many interim emission regulations to sculpt the existing industry to be equipped for the net zero-emission future.

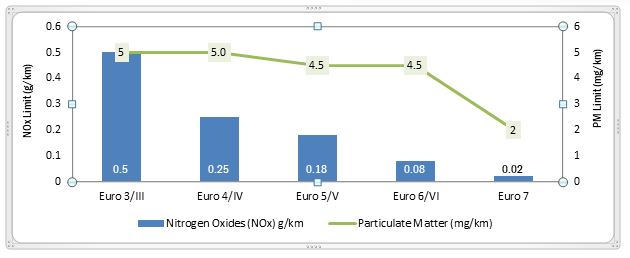

FIGURE 2 EURO 3 to Euro 7: NOX & PM EMISSION REDUCTIOn for passenger cars

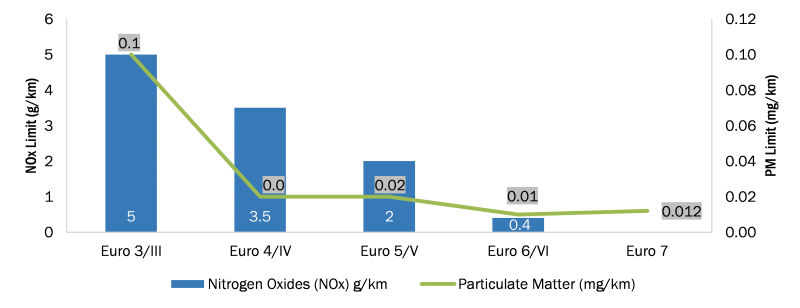

FIGURE 3 EURO 3 to Euro 7: NOX & PM EMISSION REDUCTIOn for heavy-duty vehicle

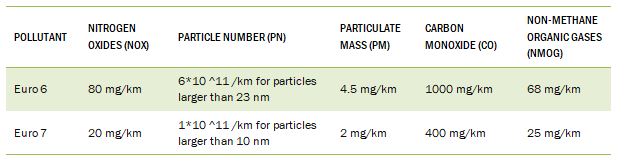

TABLE 2 POLLUTANT limit reduction under euro 6 & proposed euro 7 regulations

1.3 NEED FOR ADVANCED EXHAUST SYSTEM- AFTER TREATMENT TECHNOLOGIES

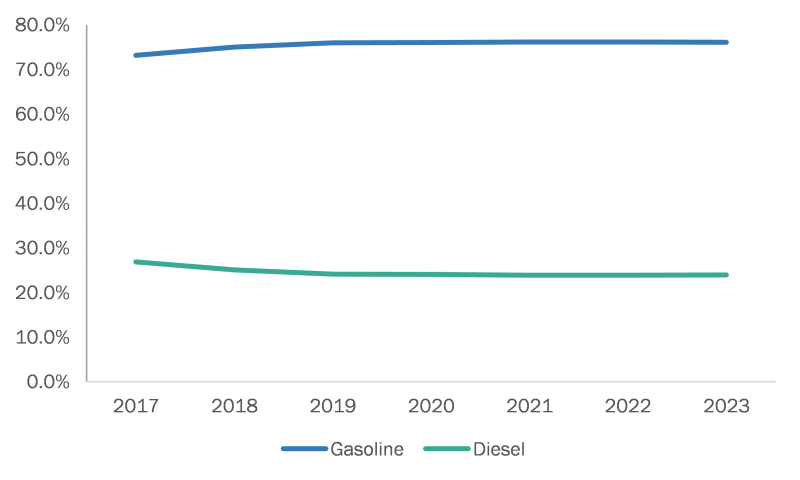

FIGURE 1 Gasoline vs. diesel passenger vehicle share (%), 2017-2023

With more stringency in emissions norms, the demand for gasoline vehicles are increasing and a sharp decline in diesel engine had been noticed. In diesel engines, advanced after-treatment devices are needed to be deployed in the vehicles. These technologies are expected to comply with strict NOx emissions and require close-coupled catalysts, dual urea injection, electric catalyst heaters, and high filtration substrates. Implementing various emission standards has shifted DOC to remain a crucial technology for diesel engines where it converts carbon monoxide & hydrocarbon to carbon dioxide but also decreases the mass of diesel particulate emissions. Further DPFs help to remove 95% of harmful PM emissions. They can be pretty temperamental and will only work under the right conditions. Under Euro VI-e, a new generation of cordierite DPF was developed to meet the targets while maintaining a lower pressure drop and high ash capacity.

1.3.1 DIESEL OXIDATION CATALYSTS (DOC)

DOC uses advanced substrate substances that catalyze chemical reactions and transform harmful emission gases into non-hazardous substances. Mixed metal oxides and zeolites are utilized as advanced to improve performance and weight reduction of the technology. In modern vehicles, DOC is getting installed with other after-treatment devices such as DOC and DPF to improve efficiency and limits harmful gases. DOC technology will get integrated with an engine control system that alters timing and quantity of fuel injection to restrict the pollutant level. Using advanced substrates will improve the design and deliver efficient outcome for a long time and also reduces maintenance cost at a significant rate

1.3.2 DIESEL PARTICULATE FILTER (DPF)

The diesel particulate filter (DPF) helps reduce particulate matter and carbon emissions from a diesel engine. It is used for the removal of particulate matter from exhaust gas by physical filtration. DPF is usually made of either cordierite or silicon carbide honeycomb structure with channels blocked at alternate ends. The usage of filter material plays a critical role and a few filter materials such as silicon carbide, aluminum titanate, cordierite, and ceramic fibers provide an improved filtration process. However, DPF needs to follow either active or passive regeneration periodically to burn out the accumulated particulate matter soots. used in the DPF. This technology is also get installed combined with after-treatment devices such as Diesel Oxidation Catalysts (DOC) and Selective Catalytic Reduction (SCR) to reduce harmful gases and enhance operational efficiency.

1.3.3 SELECTIVE CATALYTIC REDUCTION (SCR)

Automotive OEMs increasingly adopt SCR, an advanced active emission control technology. It breaks down the hydrocarbons and NOx into water and nitrogen. It uses expensive metals such as palladium, rhodium, and platinum combined with ceramic bricks that act as a catalyst and the injection of automotive ammonia, more commonly known as diesel exhaust fluid (DEF) or AdBlue, to achieve low emission levels. High-efficiency SCR technology is getting developed along with advanced dosing control for precise injection rate of urea, ammonia slip catalyst, and urea quality sensors. Advanced materials such as multiple metal oxides, vanadium-based, zeolites, etc. are used to boost emission control. Also, it can be integrated with the engine control system to control the flow and timing in the fuel injection system to optimize results

The SCR technology reduces NOx emissions by nearly 90%. Therefore, its usage in most diesel vehicles across the globe is mandated under the new emission norms. SCRs trap NOx more efficiently compared to LNTs in vehicles with large engine capacities. Hence, passenger cars and LCVs with an engine capacity of above 2.0 liters are generally equipped with SCRs as they emit more NOx than vehicles with smaller engine capacities. This led the SCR to hold the largest market share with USD 39.2 billion, registering a CAGR of 6.7% globally.

1.3.4 EXHAUST GAS RECIRCULATION (EGR)

EGR: An exhaust heat recovery system is an energy recovery system that transfers heat from process outputs at high temperatures to another part of the vehicle temperature process. An exhaust heat recovery system turns thermal losses into energy in a vehicle. This technology has caught the attention of car and heavy-duty vehicle manufacturers as an efficient way to save fuel and reduce vehicle CO2 emissions. This technology is also used in hybrid vehicles. With the increasing stringency in emission norms, OEMs and exhaust system manufacturers are developing advanced exhaust heat recovery systems such as thermoelectric generators (TEG) and organic ranking cycle (ORC). These exhaust heat recovery technologies help convert a sizable amount of exhaust heat energy and store and reuse it in another useful form for driving auxiliary vehicle functions or giving an extra boost to the engine when required. Currently, vehicles have little usage of exhaust heat recovery. However, with increasing technological advancements, exhaust heat recovery will witness tremendous growth as it can offer efficient thermal management in the vehicle.

1.3.5 GASOLINE PARTICULATE FILTER (GPF)

Gasoline particulate filters (GPFs) are used to nullify the emission effects and reduce the emissions levels of GDI engines. GPFs prevent the accumulation of soot and enable continuous regeneration of the filter. GPFs were primarily developed in North America as there is a high dependence on gasoline engines, with 88% of passenger cars and LCVs running on gasoline engines. Some GPF-equipped models are Ford Mustang, Volkswagen UP GTI, Tiguan, and Mercedes-Benz S-Class. In other regions such as Europe and Asia Pacific, adopting new emission standards and authorities provisions for OEMs to sell and promote vehicles that run on cleaner fuels will drive the demand for gasoline particulate filters. Similar to DOC, and DPF, GPF devices can be used in combination with other systems such as Three-Way Catalysts (TWCs) and NOx traps to cut down the emissions significantly. This technology also requires a regeneration process to remove the particulate matter content.

To go further, some of these after-treatment devices are combined, enabling automotive OEMs and exhaust system manufacturers to limit vehicle emissions within required regulatory restrictions. The most used after-treatment device combination includes SCR and DPF. This combination removes more than 70% of all gaseous as well as particulate matter. The SCR reduces NOx to N2 (nitrogen) and water in the presence of a reductant, while the DPF filters particulate matter. For example, BASF’s Catalysts division is offering a combination of a Diesel Oxidation Catalyst (DOC) and a Lean NOx Trap (LNT). This DOC and LNT combination offers the high HC and CO removal efficiency of a fully formulated DOC, with the ability of an LNT to trap and reduce NOx. This combination enables exhaust systems to efficiently control the emissions within the Euro 6 emission limits for diesel engines. Thus, such combinations are driving the demand for after-treatment devices and the exhaust system market.

CONCLUSION

The global automotive industry was already moving toward the complete electrification of vehicles so follow the stringent rules set by the governing bodies. The upcoming trend for hybrid electric vehicles and Euro 7 regulations for ICE engines till 2025 will generate a potential movement by shifting the focus toward introducing compliant emission reduction technologies. However, the OEMs are actively investing hue in developing diagnostic tools and after-treatment devices which compile all the proposed regulations and reduce the carbon footprints globally. Powertrain technology has already undergone a transformation and technological advancements that aim to reduce the production of greenhouse gases. In the next coming years, OEMs will be more focused on introducing sustainable technologies which will have the capacity to actively drive the future of the automobile industry. Thus, investing resources in developing technologies like EVs, hybrid, plug-in vehicles, catalytic converters, and aftermarket devices in emission control technologies will benefit the industry and the environment the most.

Diesel vehicle registrations have declined for a few years all over the world. The real-driving emissions testing and government programs to further discourage diesel vehicle use (e.g., by restricting their circulation or increasing taxes on diesel fuel) are the other significant reasons behind the recent diminish in diesel vehicle share of overall vehicle production.

This has led to new advancements in gasoline engines, such as using gasoline direct injection engines (GDI). These GDI engines offer higher fuel efficiency, and the performance also increases when coupled with a turbocharger. The gasoline direct injection (GDI) system is one such advancement that injects highly pressurized (200 bar) fuel directly into the combustion chamber to improve fuel efficiency and performance boost. As per the EU Transport and Environment Agency, GDI engines are expected to replace the existing Port Fuel Injection (PFI) gasoline engines to a large extent in 2021.

However, one of the major drawbacks of GDI engines is the high generation of particulate emissions. Hence, a gasoline particulate filter is used to keep the particulate emission in check. As a result, using a GDI system with technologies such as turbochargers and gasoline particulate filters will result in improved performance and cleaner emissions. Thus, the demand for GPF is expected to increase with growing GDI vehicle sales, especially in the US, Japan, and Europe. Thus, the GPF segment is expected to register the highest growth rate of 15.9%during the forecast period due to the growing demand for gasoline direct engines.

The passenger car and light commercial vehicles will continue to contribute a significant share of the exhaust system market in the coming years. The growing installation rate of SCR to curb NOx emissions is expected to lead to the demand for SCR technology.

Forvia (Germany), Tenneco Inc. (US), Eberspächer (Germany), Johnson Matthey (UK), and Umicore (Belgium) are the key after-treatment device suppliers. These companies are developing various advanced after-treatment devices to gain traction in the market and to aid emission reduction.

Source: MarketsandMarkets