According to MarketsandMarkets analysis, the brake systems market, by value, is estimated to be USD 22.2 billion in 2022 and projected to reach USD 28.1 billion by 2027, at a CAGR of 4.8% from 2022 to 2027.

Automotive brakes play a crucial role in any vehicle’s safety and functioning. A typical brake system comprises various components, including an ABS control module, disc brakes, drum brakes, brake pedal, emergency brake, wheel speed sensors, brake booster, master cylinder, and brake pedal.

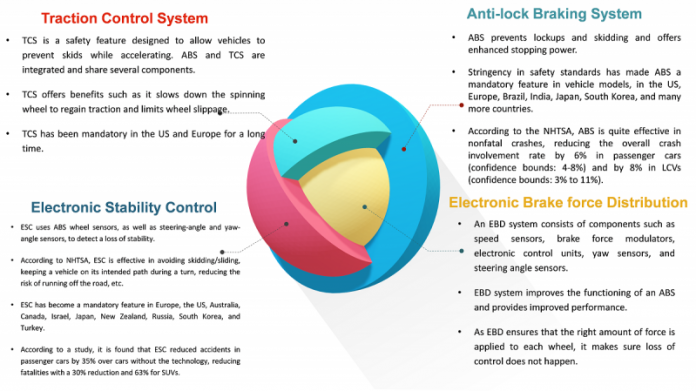

According to Utah.gov, total stopping distance is the distance a vehicle travels from the time a hazard is spotted and the brake pressed on until the vehicle stops. Most passenger vehicles are about 3,000–4,000 pounds. A passenger vehicle weighing 4,000 pounds, traveling under ideal conditions at a speed of 65 miles per hour would take 316 feet to stop. In comparison, a fully loaded tractor-trailer weighing 80,000 pounds, traveling under ideal conditions at a speed of 65 miles per hour will take 525 feet to stop. Around 60-90% of the vehicle’s stopping power comes from the front wheels. Thus, with the implementation of regulations for reduced stopping distance for enhanced safety, the adoption of disc brakes is expected to grow significantly. Use of electronic braking systems such as Anti-lock Brake Systems (ABS), Brake Assist (BA), and Electronic Brakeforce Distribution (EBD) can help reduce the stopping distance. According to the Royal Society for the Prevention of Accidents (ROSPA), ABS ensures the shortest distance in which a vehicle can be brought to rest is achieved. BA is based on the ABS technology of a vehicle and is usually used in combination with ABS. BA helps reduce the stopping distance by 45%. Thus, in the coming years, the adoption of ABS and BA is expected to grow due to the regulatory norms for vehicle safety.

Currently, Europe has the highest penetration of ESC globally. However, Asia Pacific is expected to be the fastest-growing market for ESC during the forecast period. This is mainly due to the steps respective governments and vehicle manufacturers took to make ESC a mandatory feature. According to the Ministry of Transport of Malaysia, all automakers are required to produce and sell new cars with ESC from July 2018. The Indian government is also expected to make ESC and autonomous emergency braking (AEB) a mandatory feature by 2023. Volvo AB (Sweden), Bayerische Motoren Werke AG (Germany), Audi AG (Germany), and General Motors Company (US) are among the leading ESC-equipped car manufacturers.

Increased demand for luxury passenger cars and electric vehicles to provide the opportunity for the growth of advanced braking systems

The stringency in passenger vehicle safety regulations is projected to increase the adoption of advanced brake systems. Passenger cars in Europe and North America already have significant penetration of advanced brake systems, and this penetration rate is expected to increase in the coming years. Passenger cars and SUVs with all four-wheel disc brakes are gaining popularity in Asia Pacific and RoW due to stringent safety standards making these braking systems mandatory. According to MarketsandMarkets Analysis, of total premium cars produced globally, the share of premium SUVs stood at ~53% in 2016, which grew to ~68% in 2022. US, Canada, China, Japan, and South Korea lead the premium SUVs market, constituting more than 90% of total production globally.With the reduced stopping distance regulations in SUVs the demand for disc brakes in SUVs is increasing. On the other hand, the rising concerns about global warming and the federal and state governments’ support to reduce air pollution are driving the EV market. Electric vehicles will witness high penetration of regenerative braking. According to recent technological developments, regenerative braking has the potential to improve fuel economy up to 30% in hybrid vehicles. Also, it can allow up to 60-70% of the available kinetic energy to be recovered during braking.

Using a regenerative braking system helps reduce brake emissions to a huge extent. For instance, according to Conference Eurobrake 2019, Vacuum-independent regenerative braking systems in electrified vehicles can decrease brake dust emissions by even more than 95%. The reason: regenerative braking systems allow the recovery of kinetic energy and initiate an emission-free generator braking. Thus, using advanced braking systems helps reduce non-exhaust emissions in automobiles. Governments worldwide are offering subsidies and incentives to encourage electric vehicle adoption. The demand for electric vehicles is increasing exponentially and is projected to continue soon, offering an attractive opportunity for regenerative braking system suppliers.

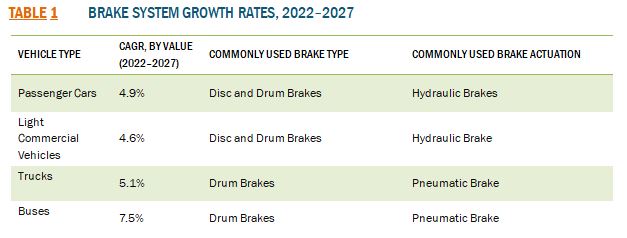

The passenger car brake system market is expected to be the largest solely due to the highest market share of production among all vehicle types. Bus is expected to be the fastest growing segment; however, from a low base, mainly due to implementation of safety regulations, making advanced brake systems a mandatory feature in coming years. Asia Pacific is expected to be the largest market for brake systems due to the shifting trend toward electronic braking systems and technological advancements.

Increasing demand of brake friction products in the aftermarket

Vehicle parc & the average replacement life of brake friction products is the key factor influencing the brake friction products aftermarket growth. The vehicle parc of Asia Pacific is projected to register a CAGR of 3-4% from 2022 to 2027. Factors responsible for this growth include an increasing average life span of vehicles, longer life of products, and increasing average miles driven. OEMs are moving from drum brakes to disc brakes in passenger cars and LCVs; hence, the market for disc brakes is projected to witness significant growth in the Asia Pacific region. Europe, which has been a pioneer in developing advanced products, has witnessed a tremendous increase in the average life of a product. This is expected to have an adverse impact on the brake fiction products aftermarket. For instance, ceramic disc brakes, which are estimated to have 35-40% extra life as compared to metallic brake discs, may run for the whole vehicle life. The development of advanced products thus poses a threat to the replacement market for brake friction products. Recent mandates regarding stopping distance in commercial vehicles have boosted the demand for brake discs and brake pads. As per the European Commission, a mixed braking system, which has a disc brake in front and a drum brake in the rear, has the lowest stopping distance. Hence, mixed braking systems are installed in heavy vehicles. Additionally, most European countries have banned asbestos brake pads and are now concentrating on lowering the copper percentage in brake discs to avoid brake dust pollution. This has led to the introduction of carbon and ceramic brake discs with a higher brake disc life. However, the introduction of advanced brake products is reducing the replacement cycle of brakes in the region.

Increased adoption of hydraulic wet brakes across off-highway vehicles

Hydraulic wet brakes are mainly used in agricultural tractors and construction equipment. A wet braking system is also called an oil-cooled or oil-immersed disc brake system. Wet brakes are a modern alternative to dry braking systems. Wet brakes offer better-stopping power, withstand harsh working conditions, and do not require frequent maintenance/repairs. This hydraulic wet brake system makes stopping the vehicle when driving through water/wet roads easier, enhancing the vehicle’s safety. All key tractor manufacturers use wet disc brakes, while only the economy models are equipped with dry disc or drum brakes. The hydraulic wet brake segment is expected to be the largest off-highway brake system market during the forecast period. Technological advancements in advanced braking systems and increasing sales of tractors, wheel loaders, and excavators are expected to drive the off-highway brake system market. Asia Pacific is the largest market for hydraulic wet brake systems. This is mainly due to the largest tractor markets ― India and China. According to MarketsandMarkets analysis, Asia Pacific accounted for ~75% of total agricultural tractor sales globally. An increase in farm mechanization is significantly boosting tractor sales, driving the hydraulic wet disc brake system market. Also, growing stringency in safety regulations in Europe and North America is expected to increase the hydraulic wet brake system market further.

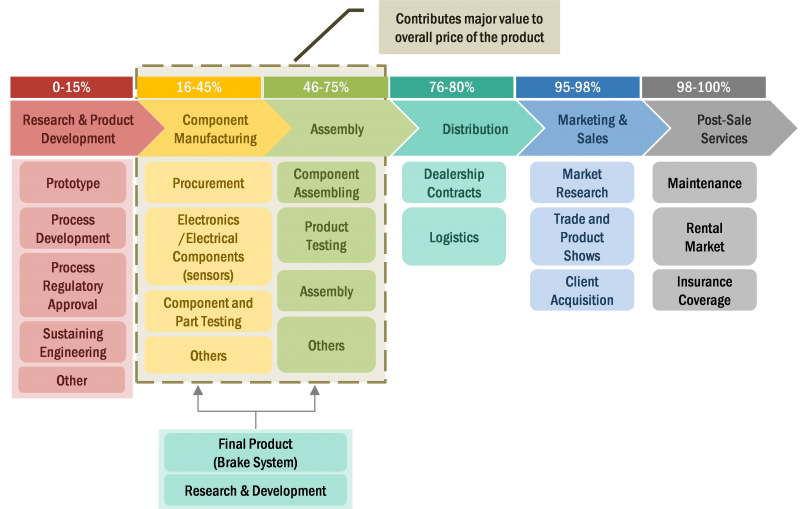

Automotive Braking System – Value Chain:

The value chain of the automotive brake system begins at the R&D stage, that includes sustainable engineering and product development. This is followed by raw material purchase and manufacturing. R&D activities are divided into in-house and outsourced tasks. In-house activities involve actual analysis and electronic interpretation of testing parameters, whereas non-critical areas are outsourced. The final product is then marketed and sold to OEMs.

Figure: Automotive Braking System Market: Value Chain Analysis

Others** include sub-distributors, etc.

Source: Annual Reports, SEC Filings, Press Releases, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis

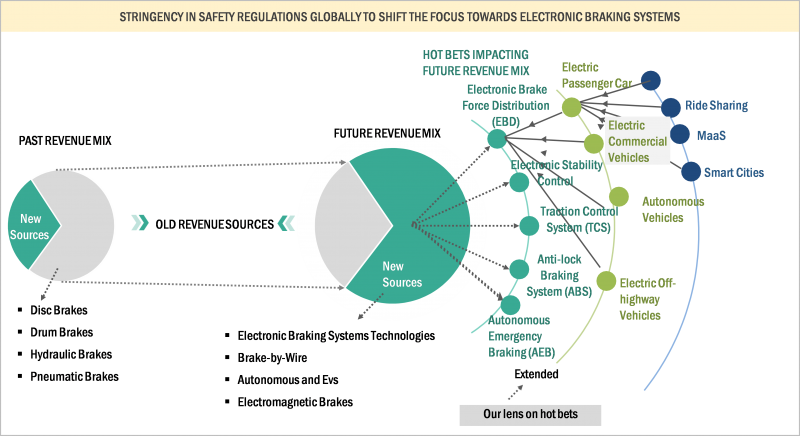

Automotive Braking System – Future Revenue Shift and Recommendations:

The growth of the automotive brakes market is directly proportional to the production of vehicles. In line with growing luxury vehicles, the market for premium SUVs has risen significantly. According to MarketsandMarkets Analysis, of total premium cars produced globally, the share of premium SUVs stood at ~53% in 2016, which grew to ~68% in 2022. US, Canada, China, Japan, and South Korea lead the premium SUVs market, constituting more than 90% of total production globally. The factors attributing to the growth of premium SUVs over premium sedans are better and more powerful engine performance. Hence, the demand for safety has greatly increased, leading to the installation of advanced braking technologies in SUVs and luxury passenger cars.

On the other hand, the rising concerns about global warming and the federal and state governments’ support to reduce air pollution drive the EV market. Electric vehicles will witness high penetration of regenerative braking. According to recent technological developments, regenerative braking has the potential to improve fuel economy up to 30% in hybrid vehicles. Also, it can allow up to 60-70% of the available kinetic energy to be recovered during braking.

The market is led by players focusing on extending their product offerings to brake system customers worldwide. Leading companies in the market include Robert Bosch (Germany), Continental AG (Germany), ZF Friedrichshafen AG (Germany), Akebono Brake Industry Co., Ltd. (Japan), and Brembo S.p.A (Italy). These companies have developed new solutions and undertaken supply orders, partnerships, and agreements to gain traction in the growing market for brake systems. For instance, in 2022, Brembo S.p.A introduced its the renewed GP4-MS brake caliper for motorcycles. This caliper is designed for nickel-coating treatment to offer strength and performance at high temperatures. The increasingly stringent active safety regulations mainly drive the market for braking systems. Asia Pacific is expected to be the leading market for braking systems, owing to the increasing vehicle production in countries such as China, Japan, and India.

Source: MarketsandMarkets