Kenya has signed deals with UAE’s ADNOC and Saudi Aramco for the supply of petroleum products with a six months credit period, a move designed to curb demand for dollars that has weakened the Kenyan Shilling. This is according to the Energy Minister, Davis Chirchir.

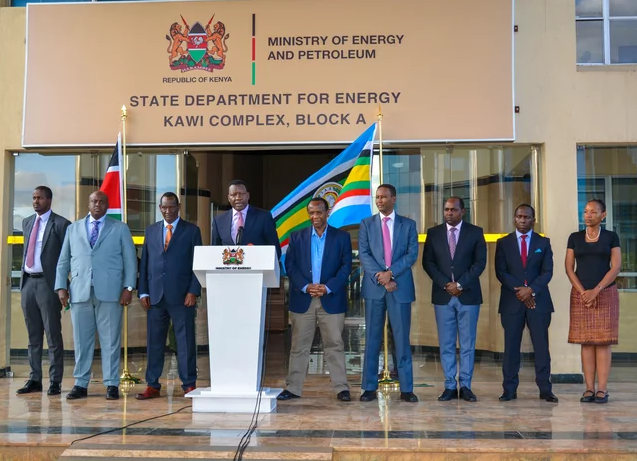

The East African nation is switching to the longer payment period from settlement on delivery, to remove the need for importers to spend hundreds of millions of dollars every month. The deals were signed on Friday, Energy Minister Davis Chirchir told a news conference, after the two firms were picked from seven bidders.

Under the six-month agreement, Saudi Aramco will supply two diesel cargo consignments monthly while the Abu Dhabi National Oil Company (ADNOC) will supply three cargo consignments of super petrol monthly.

“We did receive seven bids. The product will now be paid for in Kenyan shillings and this will ensure the dollar is available for other sectors of the economy. We have closed and signed a deal with Aramco of Saudi for the supply of two products for a period of six months,” Chirchir said.

Foreign currency traders have cast doubt on the ability of the plan to stem the pressure on the shilling currency, saying it merely amounts to a postponement of demand. The plan is also being challenged by some private petitioners at the High Court. The court is expected to give its initial directions on the case on Tuesday.