Automotive suspension plays a key role in any vehicle’s efficient and smooth functioning. Different types of suspension architecture include MacPherson strut, torsion beam, double wishbone, multilink, leaf spring, and air suspension. The selection of each architecture varies in a vehicle depending upon factors such as ride control requirement, space availability, the vehicle segment, and the suspension system’s cost. Though most passenger cars use a torsion beam in the rear to increase the boot space, the MacPherson strut dominates the front wheels. In contrast, SUVs and Luxury vehicles use multilink suspension systems to provide more comfort to the passengers. Commercial vehicles in developing countries such as China, India, Mexico, and Brazil primarily use leaf spring suspensions. Commercial vehicles in more developed western countries such as the US, Germany, and the UK use air suspension systems in their suspension modules.

Automotive OEMs are investing in R&D to introduce innovative suspension systems to enhance ride comfort. For example, in August 2020, ZF Friedrichshafen designed an air suspension with ECAS technology to address issues such as higher fuel consumption, decreased rider comfort, and compromised passenger safety and vehicular instability. The market for suspension systems is mainly driven by the increasing demand for luxury vehicles, especially passenger cars, and the increasing preference of buyers for a comfortable ride and smooth operation of the vehicle. Asia Pacific is expected to be the leading market for suspension systems, owing to the increasing vehicle production in countries such as China, Japan, and India.

Increased demand for SUVs & luxury passenger cars would drive the demand for advanced suspension systems.

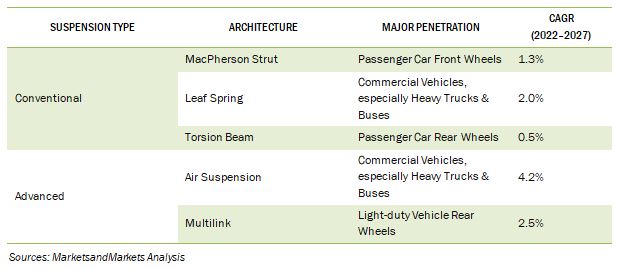

The adoption of independent suspensions has increased over the years owing to their various advantages. According to MarketsandMarkets analysis, the market for independent suspensions such as MacPherson strut, double wishbone, and multilink is expected to grow at 1.3%, 1.4%, and 2.5%, respectively, in terms of value, during the forecast period. This growth can be attributed to independent suspensions offering more stability to vehicles. An independent suspension type’s weight is less, making it a preferred choice for heavy vehicles. Passenger cars generally employ an independent suspension at the front and a dependent suspension at the rear wheel. Hence, both independent and dependent suspensions are required. MacPherson strut is one of compact passenger cars’ most preferred front independent suspensions. Low manufacturing costs and better stability are attributed to the growth of the MacPherson suspension system. A double-wishbone is another independent suspension type, providing superior comfort, dynamics, and road holding. However, as the production cost of the double wishbone is higher, it is generally used in premium models, such as Alfa Romeo, Toyota Tundra, MG Rover TF, Honda Accord, and Aston Martin DB7. The double wishbone suspension is also employed in high-performance racing cars owing to its design complexity and increased number of parts, such as joints and bearings. However, with technological advancements, mid-high segment vehicles such as Toyota Camry, Fortuner, and Honda Accord have opted for the double wishbone. According to MarketsandMarkets analysis, the growth rate of the air suspension market is expected to be 4.2% during the forecast period.

TABLE 1 Suspension architecture growth rates, 2022–2027

The demand for SUVs has also increased in the past few years globally. The SUV & sub-compact SUV market has witnessed considerable growth in countries such as the US, China, India, and Mexico, owing to the vehicles’ low cost, compact size, advanced designs, better ride comfort, and better maneuverability. This has increased the adoption of multilink suspensions in these vehicles. The decreasing cost of multilink suspension and ease of adjustment has increased the adoption of multilink suspension in the rear axle in mid to high-segment cars, as these segment customers demand higher ride comfort. Mahindra Scorpio, Volkswagen Tiguan, and Kia Sportage are some of the common SUVs equipped with multilink suspensions. Globally, the multilink suspension volume market is expected to grow at 2.7% over the forecast period.

The demand for SUVs has also increased in the past few years globally. The SUV & sub-compact SUV market has witnessed considerable growth in countries such as the US, China, India, and Mexico, owing to the vehicles’ low cost, compact size, advanced designs, better ride comfort, and better maneuverability. This has increased the adoption of multilink suspensions in these vehicles. The decreasing cost of multilink suspension and ease of adjustment has increased the adoption of multilink suspension in the rear axle in mid to high-segment cars, as these segment customers demand higher ride comfort. Mahindra Scorpio, Volkswagen Tiguan, and Kia Sportage are some of the common SUVs equipped with multilink suspensions. Globally, the multilink suspension volume market is expected to grow at 2.7% over the forecast period.

Increased adoption of air suspension systems in buses and trucks

Air suspension replaces a conventional steel spring suspension in heavier vehicle applications, like trucks, tractor-trailers, and passenger buses, thus reducing overall vehicle weight and subsequent CO2 emission.

Earlier, the leaf spring suspension was used in heavy commercial vehicles. The low manufacturing cost and the ability to distribute the load over a wider area made leaf springs a preferred choice for heavy trucks and buses. However, semi-active and active suspensions have been developed due to technological advancements allowing the air suspension system to enter the market. Adopting the air suspension system is higher in buses as comfort and ride control are primary requirements in buses. Hence, the demand for air suspension in luxury buses has risen significantly. Currently, air suspension is no longer a premium feature. Still, it has become a standard feature, especially in developed regions such as Europe and North America, as customers prefer comfort and can pay higher prices for the products. Companies that provide air suspension systems in their truck and bus models include Volvo (9400 B8R, FM series), Daimler AG (Actros L, Tourismo, and Citaro series), Scania (City Bus 4×2, S-series), and ISUZU (LT 134PR BUS series). This feature is still in its introductory phase in Asia Pacific due to the region’s cost sensitivity toward products.

Bus air suspension systems have evolved in terms of technology, components, and other parameters. In the case of heavy-duty trucks, the demand for air suspension is growing, owing to the demand for efficient transportation of goods, increasing special applications of trucks, such as refrigerated trucks and containers carrying fragile and expensive goods. The increasing demand for HCVs also aids this growth due to the globally booming e-commerce sector. The global HCV production is expected to grow from ~0.8 million units in 2022 to 8.6 million units by 2027, according to MarketsandMarkets analysis.

As the air suspension system increases its penetration in HCVs, it will likely follow the growth of global HCV vehicle production, as evidenced by the projections below.

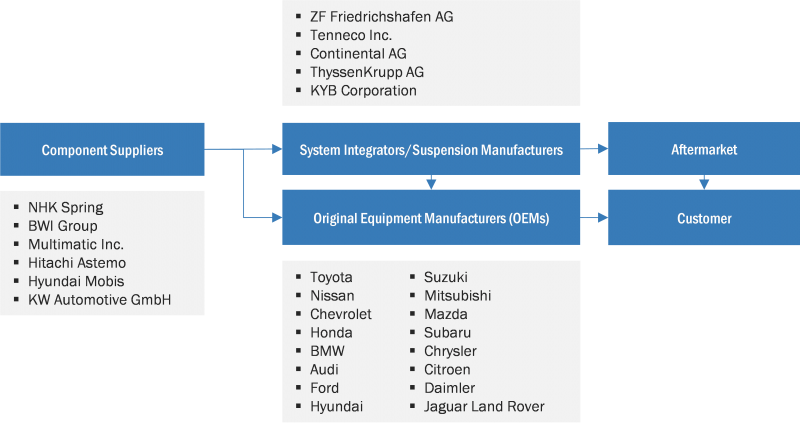

Automotive Suspension – Supply Chain and Ecosystem:

The automotive suspension market supply chain includes suspension component manufacturers, system manufacturers, and OEMs. Component suppliers provide suspension components such as shock absorbers, springs, links, and control arms to tier-1 system manufacturers. The system integrator integrates a complete suspension system and offers it to various OEMs per specifications.

FIGURE 2 Automotive Suspension System Market: Supply Chain Analysis

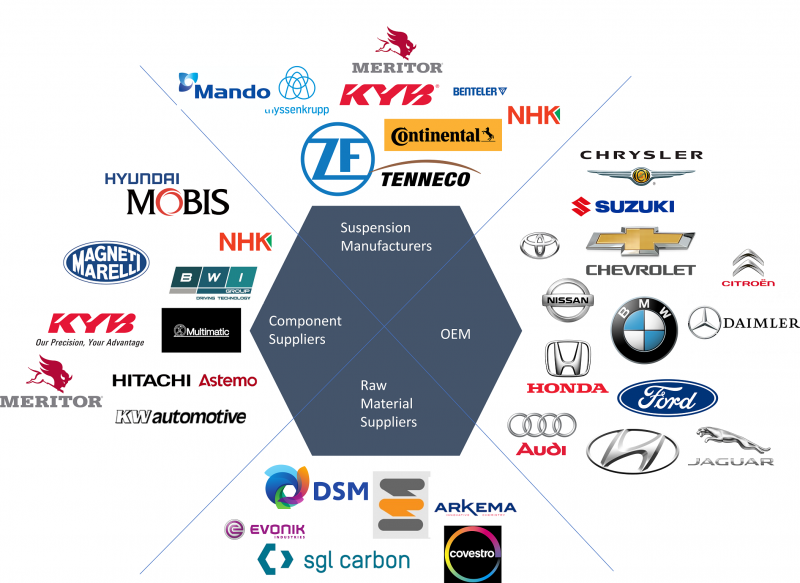

FIGURE 3 Automotive Suspension System Market Ecosystem

Sources: Secondary Research & MarketsandMarkets Analysis

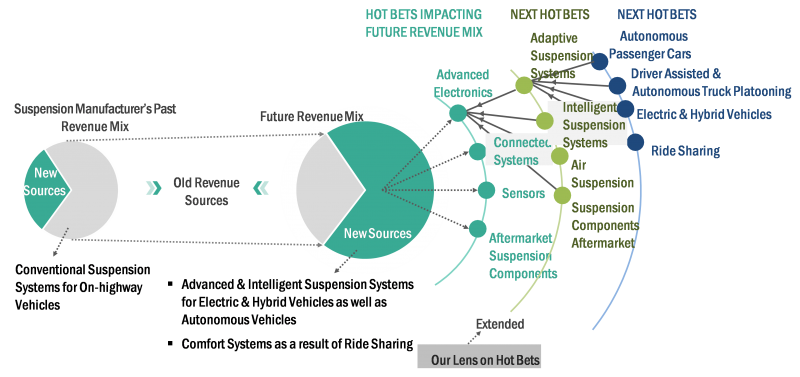

Automotive Suspension – Future Revenue Shift and Recommendations:

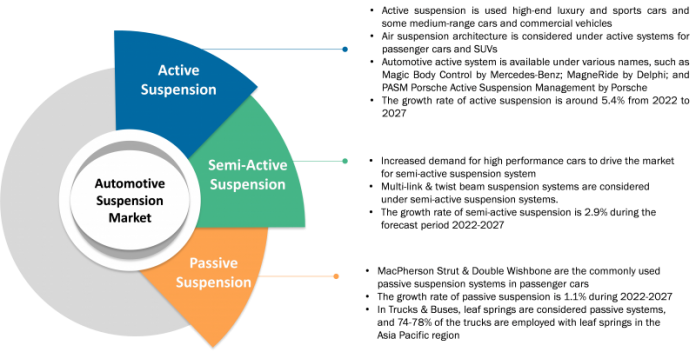

FIGURE 4 Shifting focus from Passive toward Active Suspension Systems

Source: Secondary Research and MarketsandMarkets Analysis

The growth of the automotive suspension market is directly proportional to the production of passenger vehicles. In line with growing luxury vehicles, the market for premium SUVs has risen significantly. According to MarketsandMarkets Analysis, of total premium cars produced globally, the share of premium SUVs stood at ~53% in 2016, which grew to ~68% in 2022. US, Canada, China, Japan, and South Korea lead the premium SUVs market, constituting more than 90% of total production globally. The factors attributing to the growth of premium SUVs over premium sedans are better and more powerful engine performance, and hence the demand for safety and comfort ha increased which has led to the installation of independent suspension systems in SUVs and luxury passenger cars. On the other hand, the rising concerns about global warming and the federal and state governments’ support to reduce air pollution are driving the EV market. Electric vehicles will witness high penetration of MacPherson strut, double wishbone, and multilink suspension systems. High-end EV models such as Porsche Taycan and BMW i4 use air suspension in both front and rear axles. Mid-segment vehicles such as the Kia EV6 and Tata Nexon use MacPherson strut in front and torsion beam or multilink suspension in the rear. Thus, the semi-active and active systems are expected to register high growth rates of 2.9% and 5.4% during the forecast period. With the increased demand of semi-active and active systems, the adjacent markets such as sensors, ECUs and other electronic devices market are also growing. Hence, suspension manufacturers & Tier II suppliers have adopted various growth such as new product launches, mergers & acquisitions, supply contracts, partnerships, and others to diversify their global presence and increase their market share. The automotive suspension market is consolidated. ZF Friedrichshafen AG, Tenneco Inc., Continental AG, ThyssenKrupp AG, and KYB Corporation are the top players in the market, with a 60-70% share. These players are based in North America, Europe, and Asia Pacific.

Report analysis source: MarketsandMarkets