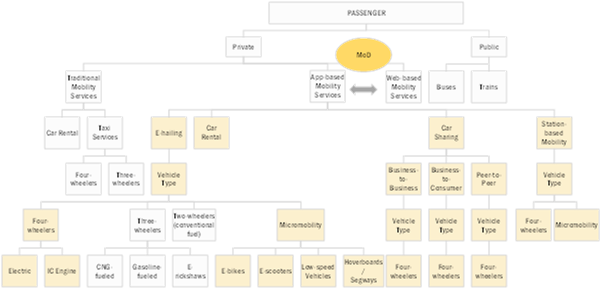

Mobility on-demand (MOD) services have already revolutionized the transport industry with their various offerings such as e-hailing, car sharing, and car rental services. However, the ride-sharing industry has seen its own set of challenges like profitability & sustainability of transport network companies, resistance from traditional transport services, local strikes of drivers, and lastly, the Covid-19 pandemic.

How Mobility-as-a-Service is different than Ride Sharing?

According to the MaaS Alliance, “Mobility-as-a-Service is an integration of various forms of transport and transport-related services into a single, comprehensive, and on-demand mobility service. MaaS offers end-users the added value of accessing mobility through a single application and a single payment channel (instead of multiple ticketing and payment operations). To meet a customer’s request, a MaaS operator hosts a diverse menu of transport options, including (but not limited to) public transport, active modes such as walking and cycling, ride/ car/bike-sharing, taxi, and car rental or lease, or a combination thereof.”

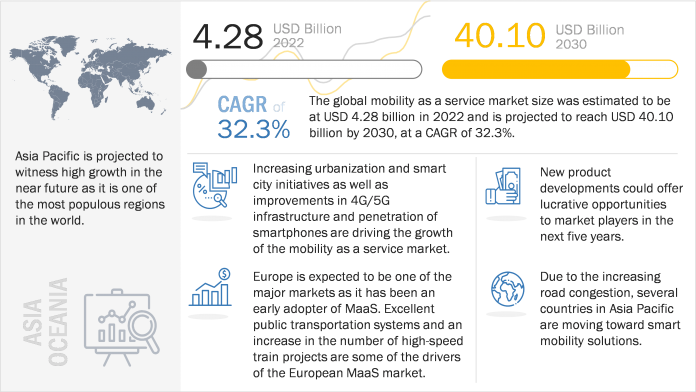

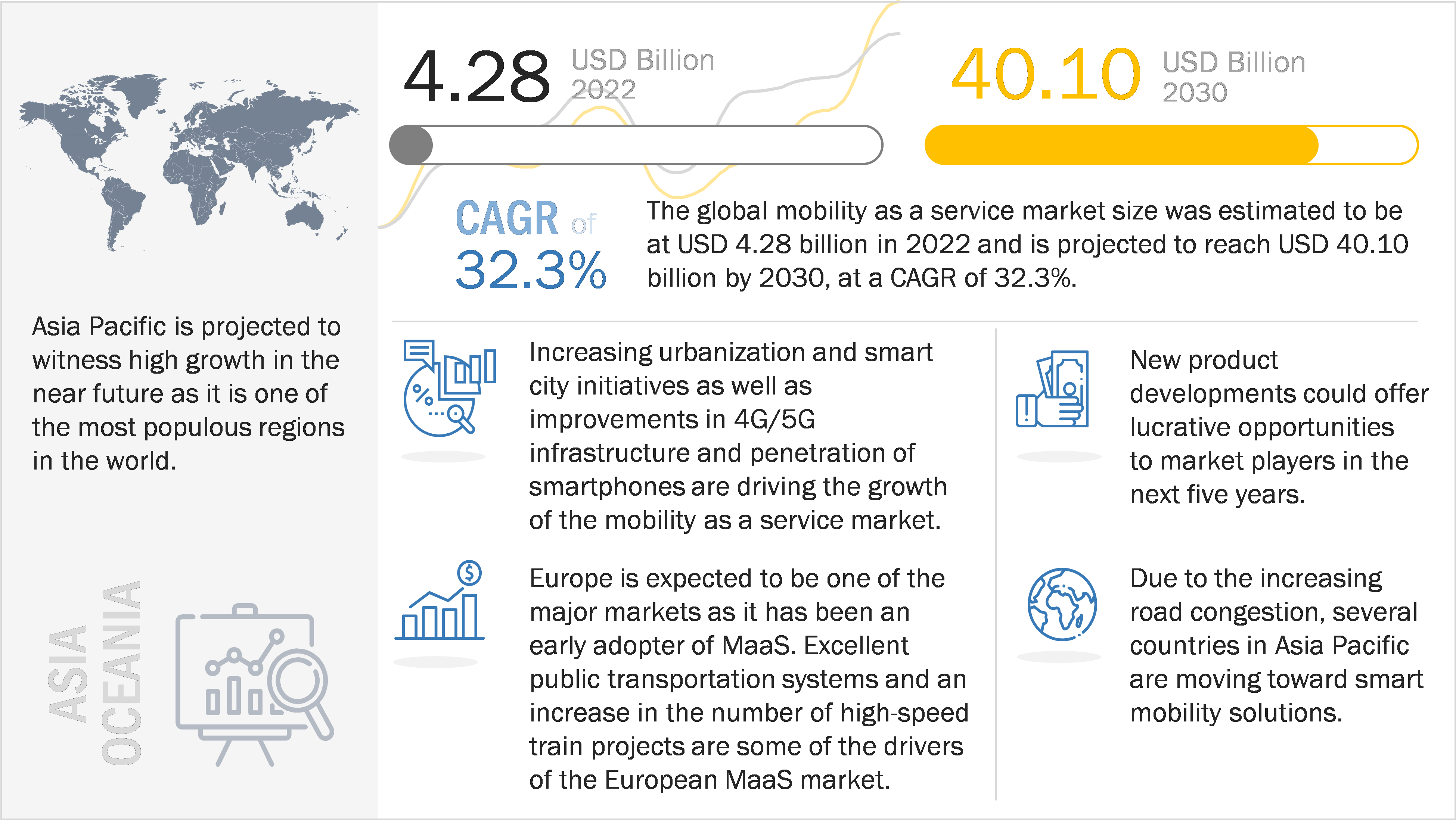

MaaS has all the transport options – from public transport to car rental to bike/car sharing, making it a suitable, affordable, and convenient way of transport. With factors such as growing smart cities worldwide, improvements in 4G/5G infrastructure, and stringent targets to reduce CO2 emissions, the Mobility-as-a-Service would see further growth in coming years.

FIGURE 1 Mobility-as-a-Service Ecosystem

Increase in Smart City Initiatives, and investments in the road & rail infrastructure!

With the increase in the urban population and traffic congestion, investments in rail and road infrastructures are on the rise. Countries are now focusing on inter-city public transport systems such as intra-city buses, metros, light rail, and high-speed rail.

MaaS implementation is further driven by the emerging focus on smart city initiatives. According to the European Commission, the smart cities project market is expected to exceed USD 2 trillion by 2025, with Europe speculated to have the highest investment globally. Countries are formulating new regulations to encourage the use of MaaS in transportation. For instance, the Finnish Act on Transport Services that came into force in 2018 aims to promote the implementation of MaaS, among other things. France is also at the forefront of the development of new mobility schemes and MaaS models. On 19th November 2019, the French Parliament adopted the Mobility Orientation Act, covering all aspects of terrestrial transportation: individual and shared cars, carpooling, buses, railways, and chauffeur-driven vehicles, along with micro-mobility such as rental bikes or electric scooters.

FIGURE 2 increasing smart city initiatives WORLDWIDE to drive market

Opportunities in the Mobility-as-a-Service ecosystem

Opportunities in the Mobility-as-a-Service ecosystem

MaaS can promote eco-friendly transportation options like electric vehicles, reducing emissions and congestion in urban areas. Electric mobility as a service (eMaaS) is gaining traction within the MaaS ecosystem. It combines highly innovative technologies and new business models to create conditions for the large-scale adoption of electric vehicles. Offering consumers attractive subscriptions for multimodal transportation can create new opportunities in the market. For instance, in 2020, Tesla presented the concept of a robo-taxi as part of a broader vision for an autonomous ride-sharing network. It estimates that running a robo-taxi will cost around USD 0.18 or less per mile; this challenges the USD 2–3 cost per mile of gasoline-powered ridesharing vehicles.

The use of big data services could also generate new opportunities for adjacent players like analytics companies. MaaS offerings can be lucrative for companies and transport authorities to invest in these new technology platforms to help manage these trends. This will help deliver information in real-time to help avoid congestion and delays and enable customers to choose travel options according to specific travel needs. For instance, Moovit Inc. owns and manages the world’s largest repository of transit data, generating hundreds of millions of data points a day. The Moovit analytics tool combines multiple data sources, including anonymized aggregated data from Moovit users, to provide detailed insights into the way people move around cities. Moovit amasses up to 6 billion anonymous data points a day to add to the world’s largest repository of transit data.

MaaS applications can also include Freight Brokering, which enables shippers and carriers to connect on-demand to ship-specific loads. Freight brokers add value by acting as a demand/ supply aggregator, creating transparency in load management, and reducing friction for shippers and carriers. Existing players in this area include Transfix, Convoy, and Uber Freight, which provide apps that serve as an aggregated marketplace. Thus, there is a huge opportunity for MaaS application providers to integrate on-demand ferry and freight services into their service offering to open up new revenue streams

Conclusion:

The increasing need to reduce carbon emissions and awareness of environmental issues have driven a growing interest in sustainable transportation options. MaaS promotes the use of shared mobility services, electric vehicles, and public transit, which are generally more eco-friendly than private car ownership. Integrating public transport and various on-demand transport services, such as ride-sharing, bike sharing, and car-pooling etc. allow passengers to complete their entire commute without using their vehicles, and this is an important aspect of the mobility mix. Ride-hailing services are likely to witness the growth of rates upward of 30% annualized. Several established OEMs are getting involved in car-sharing initiatives. Incorporating both car-sharing and car rental services within the MaaS framework enhances the diversity of transportation options available to users, catering to a wide range of travel needs and preferences.

Further, micro-mobility services such as bicycles (regular and electric), scooters, and small electric cars are gaining popularity as these are efficient and effective solutions for first-mile and last-mile commutes. The increasing population and traffic in cities will drive commuters to use more metros and high-speed trains, resulting in significant opportunities for MaaS service providers to integrate trains into their service platforms

5G network and better telecom infrastructure are expected to pave the way for a revolution in cities and inter-city mobility. Wireless communication technologies (such as DSRC) can help improve traffic safety and increase traffic flow throughput. With onboard units (OBU), connected and automated vehicles (CAVs) can reduce the driver’s perception-reaction time and improve safety. The increasing penetration of smartphones with efficient telecom infrastructure will not only assist vehicle platooning for MaaS but also assist in seamless navigation and payment services through MaaS mobile applications.

Author:

Amey Amanaji

Associate Director, MarketsandMarkets Research Pvt Ltd.