The transport sector is one of the most significant contributors to GHG emissions globally, owing to which many countries worldwide are focusing on converting the existing fleet of commercial vehicles to zero-emission electric vehicles. Introducing electric buses is expected to change global mass transit in the coming years by improving air quality, reducing noise levels, and increasing fuel efficiency. However, the industry would face challenges such as high costs for developing charging infrastructures. Unlike many developed countries, the lack of charging infrastructure is one of the major challenges in developing countries’ electric bus market growth. Also, battery technology/range and cost are the other restraining factors limiting the demand for electric buses.

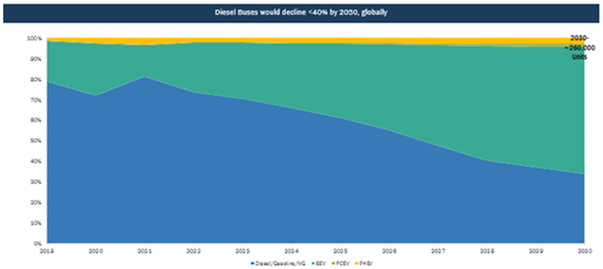

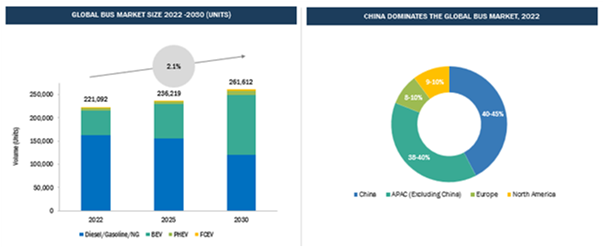

In 2022, the global bus market crossed 220,000 units, where electric buses share was slightly more than 25%. The electric bus share in the global bus market was ~20% in 2019. The growth in electric bus demand is due to two reasons – growing support from the government in terms of incentives & tax exemptions and aggressive targets set by countries to achieve 100% fleet electrification. China’s contribution to the global electric bus market in 2022 was >80%. According to an analysis by MarketsandMarkets, the global bus market is projected to cross 260,000 units by 2030, to which electric buses will contribute more than 55%.

Africa Automotive May-June digital issue 2023

- FIGURE 1 GLOBAL BUS MARKET share by propulsion (INCLUDING CHINA), 2019–2030

China: The all-time leader

The overall China bus market contributed to >40% of the global bus market, whereas China’s electric bus demand was >80% of the global electric buses in 2022. The EV subsidies in China were set to expire in 2022. However, in June 2023, the Chinese government announced a substantial tax incentive package of 520 billion yuan (~USD 72 billion) over the next four years. Under this extended policy, New Energy Vehicles (NEVs) that are purchased in 2024 and 2025 will be eligible for a complete exemption from purchase tax (a maximum of 30,000 yuan (~USD 4,150) per vehicle). For 2026 & 2027, this exemption will be reduced by half (5,000 yuan (~USD 2,000)). This extension is expected to not only boost the sale of electric vehicles but also expected to boost the Chinese economy after the pandemic.

- FIGURE 2 China Vs Global Electric Bus Market, 2022

European Electric Bus Market – Driven by CO2 Emission Targets

Heavy-duty vehicles (lorries, buses, and trucks) contribute to >25% of GHG emissions from road transport and more than 6% of total EU GHG emissions. Considering the same, European Commission proposed revising the Regulation on CO2 emission standards for heavy-duty vehicles. Previous targets were to reduce CO2 emissions to 15% by 2025 and 30% by 2030; however, with the new proposed targets, these are revised to a 45% reduction in CO2 emissions by 2030. These aggressive targets would help to achieve the EU’s 2050 climate neutrality target. To accelerate the faster deployment of zero-emission buses in cities, the EU also proposed to make all new city buses zero-emission as of 2030.

The European bus market crossed 19,000 units sale in 2022, representing ~9% of the global bus market. Europe’s electric buses contributed to 22% of the total European bus market, which according to an analysis by MarketsandMarkets, is projected to cross 50% by 2026. The European region is expected to achieve a >90% electrification of buses by 2030.

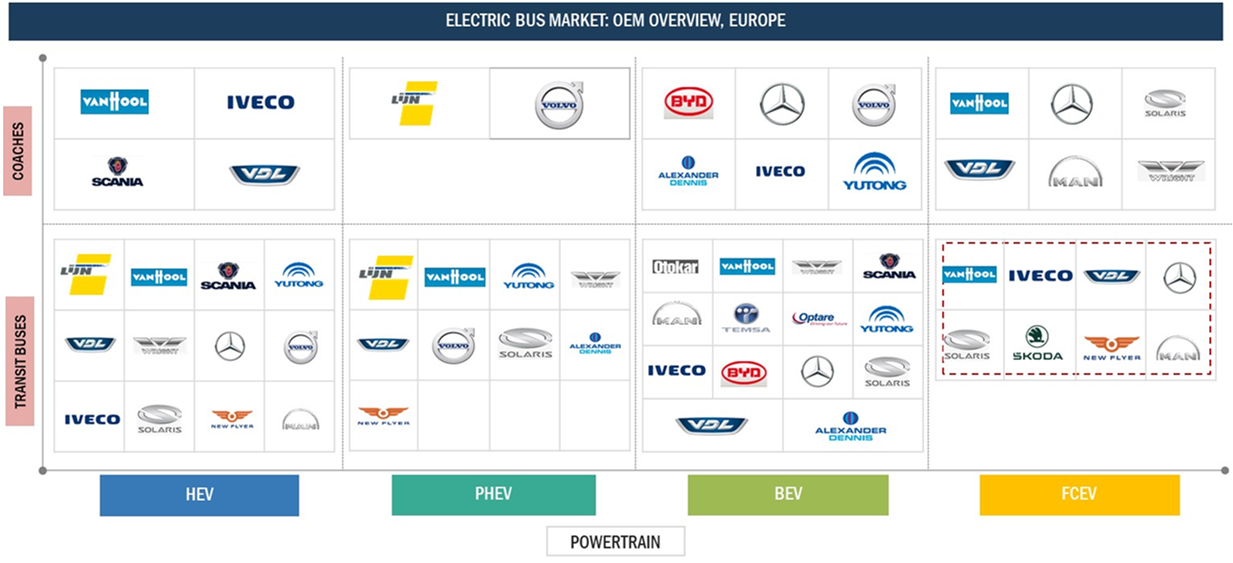

Both BEV and PHEV propulsions presently dominate the electrification in the European bus market. However, with time, the battery electric buses would have an edge in the European electric bus market. Also, the Transit and City buses largely dominate the European bus market, contributing to >65% of the total European bus market. Considering the new targets to replace all existing city buses with electric buses, this segment would achieve 100% electrification by 2030. Alternatively, the electrification in the other bus applications, such as coaches, & midi buses, would be comparatively lower.

The current European bus requirement is in 3 types – 9m (around 60 pax), 10-11m (75-85 pax), and 12m (100 pax). Considering the electrification of the buses, the ideal customer requirement can be the same as current ICE buses. However, electric buses’ most significant challenge is increasing drive range without decreasing passenger capacity. For instance, Citaro Diesel has a passenger capacity of ~103 with a driving range of ~400 km. But when replaced with NMC batteries (say 198kWh), the driving range decreases to <150 km and passenger capacity to <80. To have a driving range of >250km, the battery power has to be increased to ~400 kWh, which again decreases the passenger capacity to ~60. This challenge can be addressed by using solid-state batteries (Citaro Solo), which can attain a range of 320 km with a battery capacity of 441 kWh and a passenger capacity of 88 (an increase of 20 passengers compared to NMC batteries).

The European electric bus market is dominated by six players – Yutong, BYD-ADL, Mercedes, IVECO, VDL, and Solaris – contributing to >90% of the European electric bus market in 2022. Below is a quick overview of the key propulsion technologies available with these players.

Indian Electric Bus Market – Driven by CO2 Emission Targets

The Indian bus market crossed the 70,000 units mark in 2022, of which the electric buses were ~3%. The electric bus share in the total Indian bus market is expected to cross 20% by 2030. The Indian electric bus market is driven by central and state governments’ initiatives to promote electric commercial vehicles. In April 2019, the Government of India approved the Phase II of Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME) Scheme with an outlay of Rs. 10,000 Crore for three years. This phase aims to generate demand by supporting 7,000 e-Buses, 500,000 e-3 Wheelers, 55,000 e-Passenger Cars (including Strong Hybrid), and 1 million e-2 Wheelers. The scheme offers INR 20,000 subsidy per kWh for e-buses.

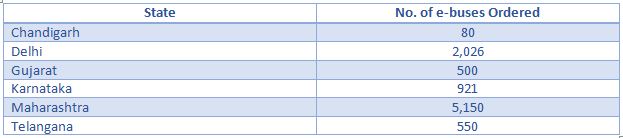

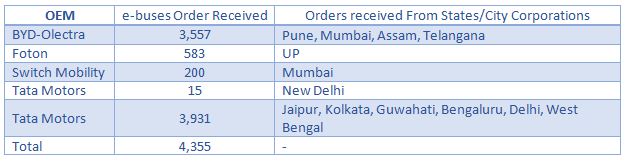

Using this subsidy, the state governments have targeted to convert their existing fleets to electric. Below is the list of orders for electric buses from a few state governments:

- TABLE 1 list of orders for electric buses from indian state governments

Most of these electric buses are transit/city buses, and a few are midi-buses. The only challenge with the Indian bus industry is that it heavily depends on China and foreign OEMs for battery technology. Also, the market is diversified with a few Indian OEMs like Tata Motors, Ashok Leyland (Switch Mobility), and PMI Electro Mobility. These three players contributed to ~40% of the electric bus market in India in 2022. BYD also has a significant presence in India, with >25% market share in 2022. Below are the future orders that these OEMs have bagged:

- TABLE 2 electric bus orders received by OEMs in india

The Indian electric bus market in the future will be driven by Smart City projects, overall improvements in the road infrastructure, and investments in charging infrastructures. However, challenges such as raw material sourcing (especially for batteries), technology, and supply chain disruptions will still haunt the Indian electric bus industry for the next few years.

North America:

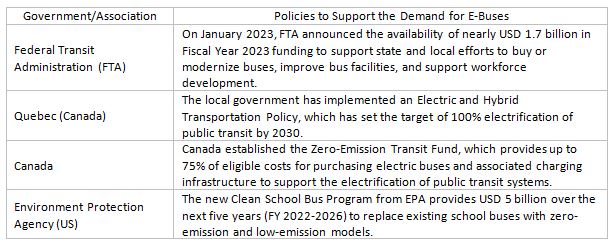

North America’s bus market accounted for 10% of the global bus market in 2022. Bus electrification in the region is at a nascent stage, where the contribution of electric buses in the total North America bus sales was ~4% in 2022. However, according to MarketsnandMarkets estimations, electric buses would contribute to >60% of the total bus sales by 2030. This growth is mainly due to government support in incentives and exemptions. For instance, On June 26, 2023, Federal Transit Administration (FTA) announced a funding of USD 1.69 billion for Low- and No-Emission Grants for Buses and Bus Facilities project selections. This would support 130 projects for people and communities in 46 states and territories. Also, EPA (Sept 2022) announced that it would double the funding awarded for clean school buses. The 2022 rebate program will fund ~2,500 school bus replacements.

Transit/City Buses and then school buses dominate the North American market. These two applications would have the highest potential for electrification. The number of electric buses in operation is growing rapidly, and government incentives are helping to make them more affordable. As the market grows, more innovative technologies and government incentives to make electric buses more affordable and attractive to transit agencies can be seen.

- TABLE 3 Recent government initiatives to boost the demand for electric buses

Source: Secondary Research, MarketsandMarkets Analysis

The future of electric buses is bright. With continued investment in research and development, the technology of electric buses will continue to improve. As the cost of electric buses comes down and charging infrastructure becomes more widespread, there will be more electric buses on the roads in the future.

Author: Amey Amanaji, Associate Director, MarketsandMarkets Research Pvt Ltd.