The electric two wheeler industry has rapidly evolved with ongoing developments in design, features, engineering, motor power, and battery technologies. With the upcoming government mandates on emissions caused by vehicles, the automotive industry is focusing on efficiency, emission-free propulsion, and innovative technologies.

The electric two-wheeler industry has witnessed rapid growth with constant developments in engineering and technology. Technological advancements, including simulation software, reality tools, telematics units, and GPS, and disruptive trends, such as the use of energy-efficient electric propulsion and innovative battery technologies, have boosted the demand for electric scooters and motorcycles. In addition to this, Policies that support electric two-wheeler (E2W) consumers and manufacturers are essential to accelerate the adoption of E2Ws and stimulate the expansion of domestic E2W production globally. The governments show signs of their intention to adopt cleaner transport modes, including electric two wheeler. Several policies have been implemented to support E2W development, such as the reduction of special consumption tax and registration fees. For Instance, FAME, or Faster Adoption and Manufacturing of (Hybrid and) Electric vehicles, is India’s flagship scheme for promoting electric mobility. Currently, in its 2nd phase of implementation, the government provides a direct incentive of Rs 15,000 (USD 182) per kWh of battery capacity (i.e., a maximum of 40 percent of the vehicle cost) on an electric scooter/motorcycle to the buyer as a subsidy.

Market players will likely invest in electric two-wheelers to enhance their vehicle performance and lower cost. While these vehicles are expected to enhance the performance and range of electric two wheelers, factors such as significant charging time, high price, limited life of batteries, and inadequate availability of charging stations make users hesitant to opt for electric two wheelers over ICE two wheelers. Thus, electric two-wheeler manufacturers and government support are likely to overcome these challenges by developing advanced batteries with higher range, innovative fast and rapid-charging solutions.

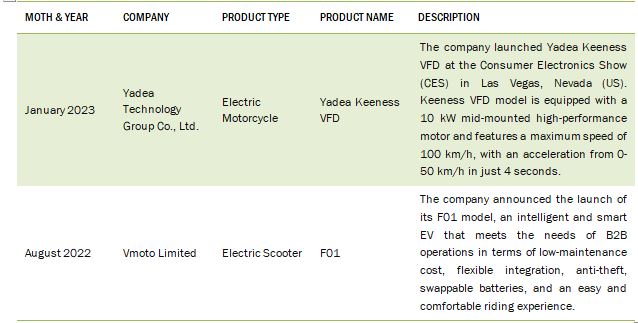

The manufacturers are focused on launching electric scooter and motorcycle models. The table below covers a few of the new models launched by key manufacturers.

Electric two wheeler launch, by OEMs, 2022-2023

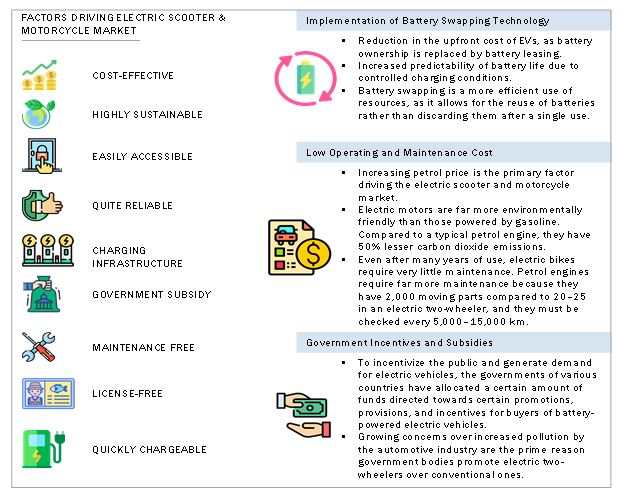

The electric scooter and motorcycle industry is witnessing technological developments to meet customer demand and be future-ready. Electric scooters and motorcycles have a lower operating cost than conventional two-wheelers. Increasing crude oil prices and the need for eco-friendly mobility alternatives are opening opportunities for the market. Electric two-wheelers are low in cost relative to ICE two wheelers and a sustainable means of transportation. They can leverage existing and future mainstream electric vehicle charging infrastructures. Governing bodies have launched initiatives to build charging facilities. The schemes are funded with huge budgets, focused on promoting electric two-wheelers through subsidies.

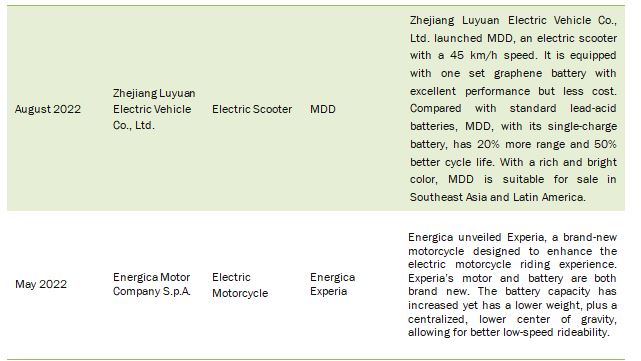

Global ELECTRIC SCOOTER AND MOTORCYCLE Sales, 2018-2022

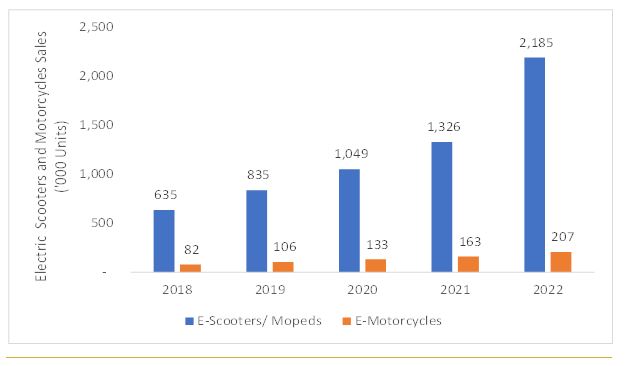

As per Atin Jain, Team Lead (Automotive and Transportation domain) at MarketsandMarkets Research, “The demand for advance battery technologies with higher driving range miles is rising due to which most electric two wheelers manufacturers have invested on R&D to offer safe battery chemistry and design features. The Asia Pacific region is among the most promising markets for electric scooters and motorcycles as the region hold more than 90% of the market share in 2023”. Further, as per Jeet Shah, Senior Research Analyst (Automotive and Transportation domain) at MarketsandMarkets Research, “Favorable government regulatory policies and initiatives coupled with growing awareness of emission-free vehicles will propel the market growth of electric scooter and motorcycle in the near future.”

INCREASING DEMAND FOR EFFICIENT AND EMISSION-FREE COMMUTES TO DRIVE MARKET GROWTH

According to MarketsandMarkets research, the global electric scooter and motorcycle market is projected to reach USD 14.7 billion by 2028, starting from USD 4.8 billion in 2023, growing at a CAGR of 24.8%. The market growth is governed by improved battery technology, supporting government policies and regulations, and the consistent launch of new electric scooters and motorcycle models.

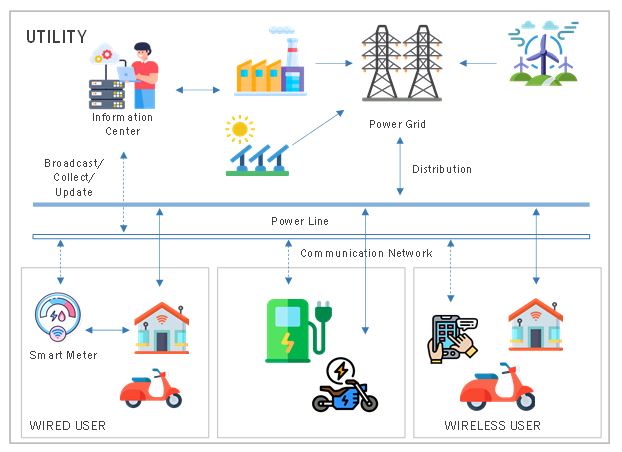

Smart IoT-based technology used in electric two-wheeler charging stations

The increasing adoption of smartphones and connectivity solutions has inspired electric two-wheeler manufacturers to connect smartphones with electric two-wheelers and infrastructure instrument clusters for more enhanced operation. Smartphones can be easily connected via wireless LAN (WLAN), USB, or Bluetooth. Most electric two-wheeler charging station manufacturers have been developing smart electric two-wheeler charging stations with IoT-based features for load management and smart connectivity. Home charging stations these days come with software for charging analysis of electric two-wheelers. On the other hand, public and semi-public electric two-wheeler charging stations come with smart payment and power management features for better power control and ease of electric two-wheeler charging by customers.

KEY DRIVING FACTOR FOR THE ELECTRIC SCOOTER AND MOTORCYCLE MARKET

-

Government incentives and subsidies

Growing concerns over increased pollution by the automotive industry are the prime reason government bodies promote electric two-wheelers over conventional ones. They have recognized the need to promote energy-efficient vehicles to reduce the increasing pollution. To attract and encourage people to buy electric two-wheelers, government bodies of different countries are introducing lucrative schemes and incentives that include formidable discounts, free electricity (initially), and free public charging stations. Governments are also working with manufacturers to build charging and manufacturing facilities, exempting them from taxation. These factors are expected to drive the electric scooter and motorcycle market in the future.

-

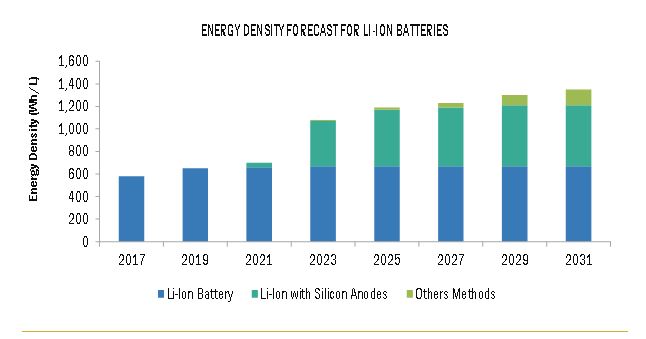

Advancements in battery technology

The battery is a significant component in an electric scooter or motorcycle. Technological advances in batteries, especially regarding their charge density, making them extractable and more competitive, are the focus of the electric scooter segment’s leading research and development efforts worldwide. Currently, companies are providing multiple charging options that include a portable charger that can be used to charge vehicles in public places. Besides, charging stations are also installed at homes for convenience.

Several companies in EV battery technology have made substantial improvements. For instance, in June 2022, CATL unveiled its Qilin Battery, the third generation of its CTP (cell-to-pack) technology. The battery delivers a range of 1,000 km, has an energy density of up to 255 Wh/kg, and is expected to be mass-produced in 2023. Such ongoing developments in the field of EV batteries are targeted towards improving the range of electric two-wheelers, with most major EV battery manufacturers innovating in the battery design and chemistry to extend the range of EVs to eliminate the requirement for regular charging.

Average energy density (Wh/L) of li-ion batteries, 2017–2031

-

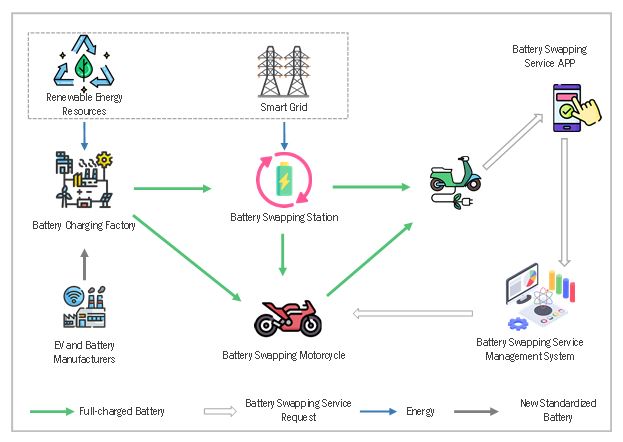

Implementation of battery swapping technology

Battery swapping is a new technology that allows the owners of electric vehicles to swap out their dying or dead batteries with fully charged ones. This development could completely transform the EV market and improve the comfort and ease of long-distance driving for motorists. Automatic and manual battery switching are the two main methods used in battery swapping. The automated approach involves changing the batteries with a robotic arm, much like the changing of oil at a gas station. In a manual technique, a drained battery must be removed from the car and replaced with a fully charged one.

Battery swapping system

key target by market players

-

Yadea Technology Group Co., Ltd. Witnessed Rapid Globalization, Multiple Tech Breakthroughs and Esthetic Innovations

Yadea Technology Group Co., Ltd. has a range of products designed for personal use and commercial deliveries, with a specific focus on improving its existing product line. With 60 million users worldwide and goods that are currently sold in 100 countries and regions, Yadea’s global future appears to be brighter beyond 2022. Yadea’s products are presently sold on five continents. The Company has created several overseas subsidiaries with qualified product R&D and sales teams to carry out more systematic localized operations to satisfy the needs of regional users in nations like Germany, Vietnam, and the US. In June 2022, the company launched its latest offering in the popular Guanneng range. The all-new Guanneng 3 represents a new generation of long-range, intelligent electric vehicles with breakthrough, long-lasting battery technology.

-

Hero Electric ExpectS 12-30 million electric 2-wheelers in India by 2030

Hero Electric has huge brand equity and is the market leader in the Indian electric scooter market. The brand has been recognized globally, offering more opportunities for global expansion. It has the largest market share in the Indian electric two-wheeler segment. It is strongly focused on growth and has partnered with many companies. Hero Electric about the projections for two-wheelers. According to the Company Managing Director, even if 30 percent of industry volumes go electric, this would translate into “about 10-12 million units” by 2030. On a more optimistic level, the 30 million mark is attainable if the entire two-wheeler buyer base embraces e-mobility in the next decade.

-

Okinawa Autotech will invest more than USD 26 million in new product development over the next three year

Okinawa Autotech, a manufacturer of electric two-wheelers, announced that it would spend USD 26.4 million (25 million euros) to create new models and powertrains over the next three years. According to the corporation, the project will be developed at its first research and development facility in Italy, opened in January 2023, and established in collaboration with its joint venture partner Tacita. An electric cruiser motorbike is expected to be the first item created at the global center in India in the coming months.

key technology development

-

Battery Related Services

Various Chinese companies have developed ideas like integrating batteries with technologies like the Internet of Things (IoT). These concepts will enable battery traceability, continuous monitoring of battery health, and detecting or preventing battery failure by early detection of issues. The adoption of integrating services will also allow battery providers to collaborate with OEMs by providing them with valuable auto-generated feedback on battery performance. This will enable OEMs to work on further battery performance improvement.

Companies like CATL and NIO have launched the Battery-as-a-Service (BaaS) model that will provide battery services like battery swapping to save time on re-charging the battery. This model will enable EV users to save money by renting the batteries instead of buying them with EVs.

-

Regenerative Braking

Regenerative braking is already present in conventional ICE as well as electric four-wheelers. This phenomenon is now being introduced to electric two-wheelers to make them more efficient, resulting in an increased riding range. Due to their design, electric two-wheelers are more suitable for regenerative braking than ICE two-wheelers. Ola S1 has regenerative braking in which energy from braking is returned to the battery. Regenerative braking is a mechanism or phenomenon where the kinetic energy or momentum that would have otherwise been wasted due to deceleration and braking is recovered, stored, and then used accordingly. In the case of electric two-wheelers, the energy recovered might help improve the range. Electric two-wheelers consist of batteries, drive, control, and transmission systems, having fewer moving parts and different designs than ICE two-wheelers. This makes electric two-wheelers more suitable for regenerative braking.

Credit: marketsandmarkets