Autonomous forklifts, also known as self-driving ones, are industrial vehicles that can operate without human intervention or minimal human supervision. These forklifts use sensors, cameras, and advanced algorithms to navigate a warehouse, manufacturing facility, or other industrial environments. Autonomous forklifts are designed and developed to accomplish various tasks, including moving heavy loads and transporting goods from one location to another. Autonomous forklifts are equipped with advanced technology to operate safely and efficiently, avoiding collisions with obstacles and other vehicles within the factory or warehouse.

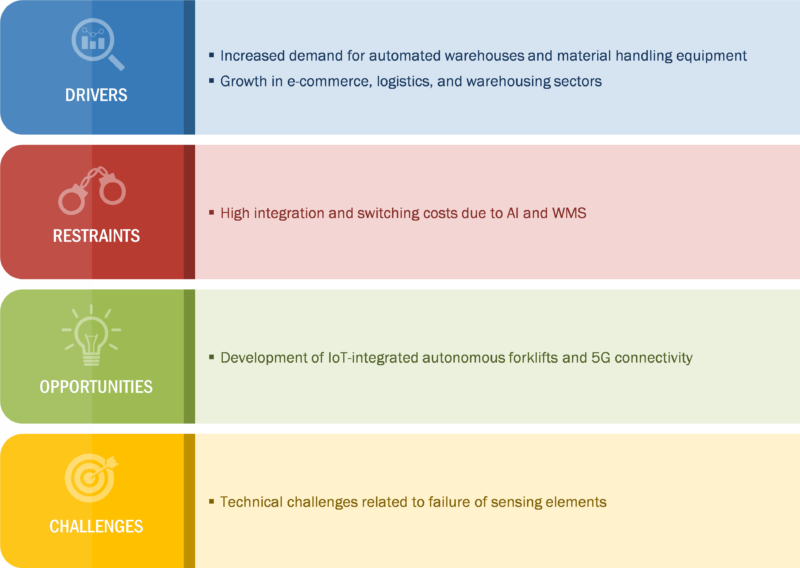

Autonomous forklifts offer several operational advantages, like movement in narrow aisles compared to the space required by a conventional forklift to maneuver. The modification needed to the warehouse is less than other material handling systems like stacker cranes. The AI system optimizes the movement of forklifts to increase energy efficiency, and heavy loads can be efficiently transported without any danger. These advantages have resulted in the growth of autonomous forklifts in material handling operations in manufacturing and logistics.

Autonomous forklifts are segmented as indoor and outdoor. Indoor autonomous forklifts are swift and precise in storage and retrieval, allowing quick response to mixed pallets, which was time-consuming with traditional storage and retrieval methods. Fundamentally, outdoor autonomous forklifts are like indoor forklifts, except they have better load handling capacity and are more robust to bear harsh weather. The outdoor autonomous forklifts are usually used on ports.

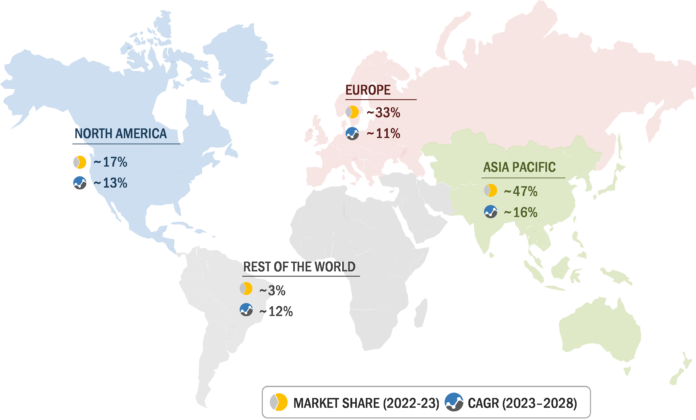

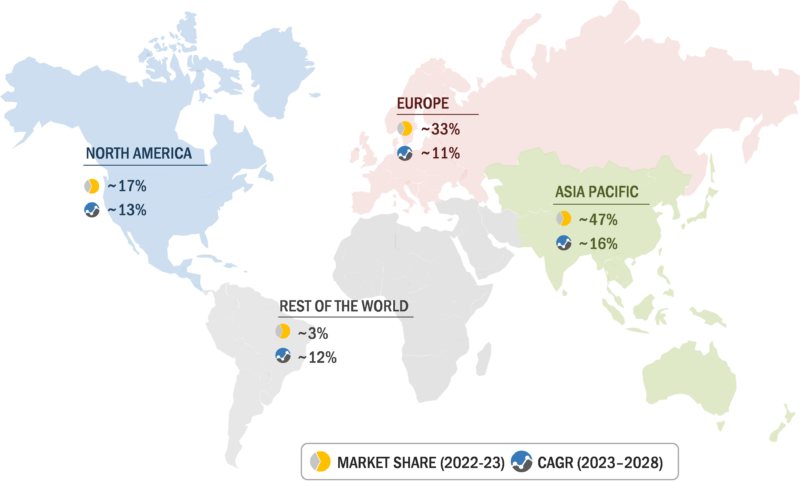

Asia Pacific is predicted to dominate the autonomous forklift market due to an increase in the adoption of automation technology for greater work efficiency. The expanding exports of FMCG, automotive, food & beverage, and pharmaceutical industries can be linked to the rise of autonomous forklifts. Increased product differentiation and rising consumer spending on consumer goods in the local e-commerce sector have boosted the use of automated intralogistics systems in China, South Korea, and India. According to MarketsandMarkets analysis, Asia Pacific accounted for >50% of the global autonomous forklift market, and China is the most significant contributor to the Asian autonomous forklift market. Toyota Industries Corporation (Japan), Hyundai Construction Equipment Co., Ltd. (South Korea), Anhui Heli Co., Ltd. (China), Hangcha Group Co (China), and Multiway Robotics (Shenzhen) Company (China) are a few of the manufacturers of autonomous forklifts in this region.

<5-ton autonomous forklifts are expected to lead the market with a market share of >60% and grow at a compounded growth rate of 14% during the forecast period. These autonomous forklifts are suitable for applications in compact places due to their low energy consumption, quick operations, and ease of maneuverability. The 5–10-ton autonomous forklifts are gaining popularity. They are used for heavy operational activities with high uptime, handling of the eccentric-shaped load, and greater stability. Some of the top manufacturers of autonomous forklifts with a 5–10-ton capacity are Toyota Industries Corporation (Japan) and KION Group (Germany). Above 10-ton autonomous forklifts primarily find applications for heavy-duty material handling outside the warehouse or the distribution centers. Above 10-ton autonomous forklifts require high energy consumption and power to operate and, hence, have diesel or gasoline propulsion.

Autonomous forklifts with electric propulsion hold the largest share, with >90% in 2023. Autonomous electric forklifts are environment-friendly options with carbon monoxide and other harmful chemical emissions, offering a safer working environment for employees, especially in closed warehouses and floor areas. As autonomous forklifts are primarily preferred in indoor applications with a maximum share of lifting below 5-ton capacity, electric forklifts have higher demand. Lithium-ion batteries are mainly preferred as they have higher energy density and less hazardous components. These forklifts are pollution-free and operate efficiently with minimum noise.

Vision and laser guidance navigation technologies are major contributors to the working of autonomous forklifts. Both these technologies are expected to contribute >60% of all technologies. The laser guidance technology has the largest demand due to its speed, low maintenance, high-temperature operability, cost-effectiveness, and accuracy. Laser-guided navigation is predominantly used in Very Narrow Aisle (VNA) forklifts and reach lift trucks. Alternatively, some end-users have started adopting SLAM technology for autonomous forklifts due to the accurate positioning and real-time data mapping of surrounding space. SLAM navigation technology can work with various sensors, such as cameras, lidars, and radars, providing flexibility for different applications and environments. In addition, SLAM navigation technology can be attributed to factors such as real-time environment positioning, adaptability, and reduced chances of injuries within warehouses or distribution centers. SLAM with vision guidance and SLAM with LiDAR sensors navigation are the fastest growing technologies. Moreover, the ongoing R&D in applications of AI and IoT in navigation technologies will eliminate further risks of errors for highly efficient operations.

Conclusion:

In conclusion, the market for autonomous forklifts is poised for significant growth, driven by several key factors. Notably, the substantial contributions from China and the broader Asia-Pacific region underscore the region’s pivotal role in shaping the future of autonomous forklift adoption.

The dominance of electric forklifts equipped with advanced technologies like laser and vision guidance is expected to be a leading trend. This shift is not merely a technological advancement but a strategic move towards efficiency and precision. Laser and vision-guided forklifts offer benefits such as enhanced navigation, increased accuracy in load handling, and improved safety measures, elevating their appeal in the market.

One of the primary drivers of the growing demand for autonomous forklifts is the material handling and warehousing sector. Autonomous forklifts are proficient at navigating complex warehouse environments, optimizing inventory management, and reducing operational costs. Their ability to operate continuously without breaks significantly enhances productivity and contributes to a more streamlined and responsive supply chain.

As industries increasingly recognize the advantages of autonomous forklifts in terms of productivity, safety, and cost-effectiveness, the market is expected to witness robust growth. The convergence of technological advancements, regional contributions, and the ever-expanding applications in material handling and warehousing positions autonomous forklifts as a transformative force in modern logistics.