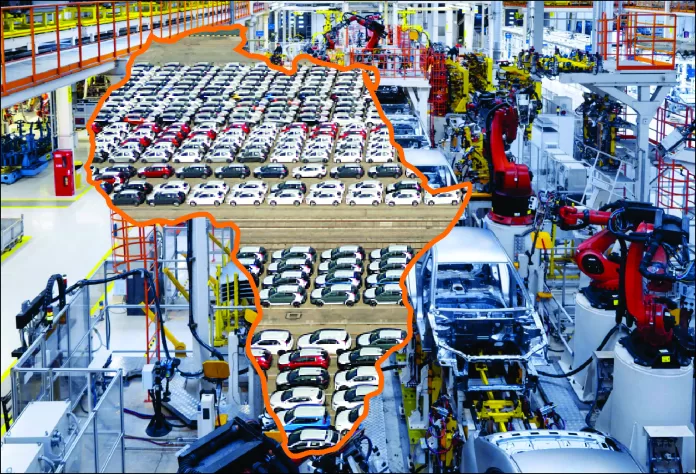

Morocco is emerging as the top car producer in Africa, surpassing South Africa. This shift is due to significant investments and partnerships with global car companies like Renault-Dacia and Stellantis. For a long time, South Africa held the title of the biggest vehicle manufacturer in Africa. However, Nigeria took over as the largest economy in Africa in the mid-2010s, and now Morocco has claimed the crown as Africa’s major vehicle manufacturer.

Production Numbers

In 2023, Morocco produced 582,000 cars and LCVs, and this year, that number is expected to rise to nearly 614,000 units. On the other hand, South Africa’s light-vehicle production is projected to decrease to 591,000 units. The decline of South Africa’s automotive industry can be attributed to various factors such as worsening industrial logistics, high vehicle taxes affecting local demand, and overreliance on automotive exports, particularly catalytic converters.

Morocco’s Strategy

Morocco’s rise as a vehicle manufacturing hub is a result of its strategic approach to incentivizing investments in the automotive supply chain. Companies like Renault-Dacia and Stellantis have set up factories in Morocco, contributing to the country’s automotive success. Nonetheless, Morocco has been proactive in developing industries that cater to the EV value chain, anticipating the growing demand for electric vehicles in Europe. Recently, Dacia launched production of the Jogger, the first hybrid vehicle manufactured in Morocco, and a Giga factory capable of manufacturing 20 GWh in battery capacity per year is set to open in 2026.

Chinese Investments

Morocco has free trade agreements with China, the U.S., and the EU. This allows Chinese manufacturers to potentially set up factories in Morocco to avoid tariffs and trade barriers imposed by the EU and the U.S. on vehicle imports from China.

Future Outlook

As Morocco’s automotive industry continues to grow, it is expected to play a significant role not only in Africa but also in Europe and the U.S. The country’s automotive manufacturing industry is projected to expand at an average annual rate of 6.8% over the next decade, reaching an annual volume of nearly 1.1 million units by 2033.

Challenges Ahead

While Morocco’s automotive muscle is increasing, questions remain about the extent of Chinese influence in the country’s automotive sector. The U.S. and the EU may develop policies to address Chinese automotive investments in Morocco, similar to the pressure being exerted on Mexico.

Morocco is poised to become a key player in automotive manufacturing for markets in Africa, Europe, and North America, solidifying its position as a major player in the global automotive industry.