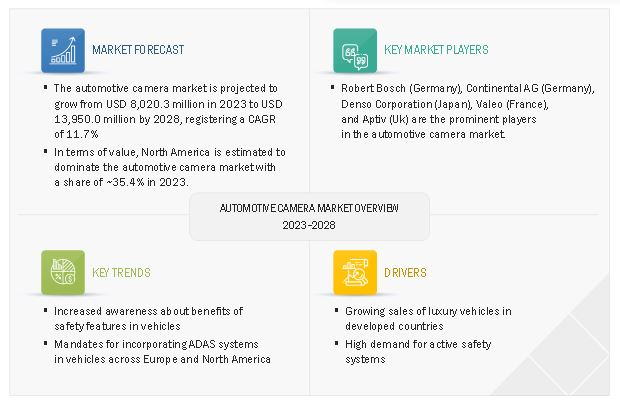

According to MarketsandMarkets Analysis, the automotive camera market is estimated to be USD 8.0 billion in 2023 and projected to reach USD 13.9 billion by 2028, at a CAGR of 11.7%. The market growth can be attributed to improved road safety standards, supportive legislation, consumer awareness of active safety features, high customization, and customer-centric technological development. These factors have encouraged OEMs to focus on developing automotive cameras, attracting the targeted audience globally.

Automotive Camera Market – Global Trends

Driver Assistant Features – Key Fueling Factor for the Growth of Automotive Cameras

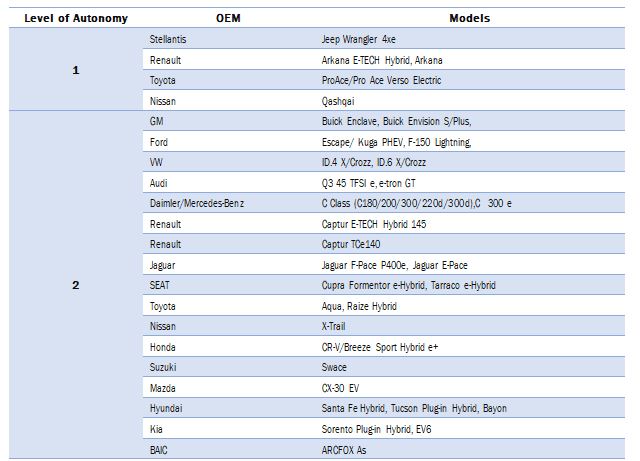

With an increase in demand for driver assistance systems and increasing automation of modern vehicles, the installation of automotive cameras is growing. Most passenger cars come with Level 1 autonomous systems. However, with increased sales of premium passenger cars, Level 2 autonomous systems are also getting popular. Some luxury vehicles are also equipped with Level 3 autonomous features. Presently, ~90% of autonomous cars have L1 autonomous features – adaptive cruise control, lane departure warning, tire pressure monitoring systems, and adaptive front lights. The L2 autonomous cars contribute to ~9% and come with features such as automated park assist, highway Chauffeur, highway pilot, and autopilot. The penetration of L3 vehicles is <1%. Most of these driver assistance features in L1 and L2 vehicles require an image sensor/camera. With the increase in demand for these vehicles, the demand for automotive cameras is set to rise.

OEMs and Their Autonomous Models:

Furthermore, in the next five years – post-2027, the Level 3 autonomy is projected to showcase a potential growth in mid-tier and luxury passenger cars owing to technological advancements. Level 3 (conditional automation) autonomy requires automated functions like Intelligent Park Assist, Night Vision System, Intelligent Cruise Control, and high-resolution camera features. With this, advanced camera systems like fusion sensors would be more required.

The North American and Asia Pacific regions are expected to lead the automotive camera market. These regions have government mandates for various vehicle safety features. For instance, NHTSA mandated the installation of backup cameras for all new vehicles under USD 10,000 by 2018. Euro NCAP implemented a regulation for deploying Driver Monitoring Systems in all new vehicles by 2024 to get the highest crash & safety ratings, which involves the installation of a DMS camera. In 2021, Japan mandated all new cars to have an automatic braking system to prevent accidents, including cars or pedestrians. These regulatory mandates are driving the demand for driver assistance features in these regions and will propel the demand for automotive cameras.

The automotive camera market comprises several global players, making it highly competitive. Continental (Germany), Robert Bosch (Germany), Valeo (France), Aptiv (Ireland), and Denso Corporation (Japan) are projected to dominate the automotive camera market with their high investment in new product development, merger, and acquisition with the potential players in the global market. Top OEMs plan to launch Level 3 semi-autonomous vehicle models and conduct testing on Level 4 autonomous vehicles. This will create huge opportunities for the key manufacturers to launch advanced camera-based solutions and offer futuristic growth prospects for the overall automotive camera market in the coming years.

Hence, growing initiatives for safety vehicle features and increasing penetration of camera-based solutions are primarily driving the growth of the automotive camera market. In contrast, rising demand for electric vehicles and new model launches with advanced features will create lucrative growth opportunities for the futuristic growth of the automotive camera market.

Advanced Driving Assistance System (ADAS) is projected to provide the opportunity for the growth of automotive cameras.

Electric Vehicles – Future Opportunity for Automotive Camera Manufacturers

Electric Vehicles – Future Opportunity for Automotive Camera Manufacturers

Moving towards sustainable mobility options, electric vehicle sales is gaining momentum worldwide, giving rise to futuristic opportunities for the growth of the automotive camera market. Electric vehicle sales increased by 16% from 2020 to 2021 globally. With the clean vehicle targets set by different governments, the demand for electric passenger cars is expected to grow at a CAGR of ~22% from 2022 to 2030. As the installation rate of automotive cameras is highest in electric passenger cars, the growing sales of electric passenger cars are set to increase the sales of automotive cameras.

Blind Spot Detection (BSD), BSD+Lane Keep Assist+Lane Departure Warning, and Intelligent Park Assist are the top three driver assistance systems in electric vehicles. Unlike traditional gasoline-powered vehicles, EVs produce very little noise, making them difficult for pedestrians and cyclists to hear. This can increase the risk of accidents, especially when changing lanes or merging onto a highway. BSD is an important ADAS feature for EVs that can significantly improve driving safety, increase awareness, reduce stress, and offer environmental benefits.

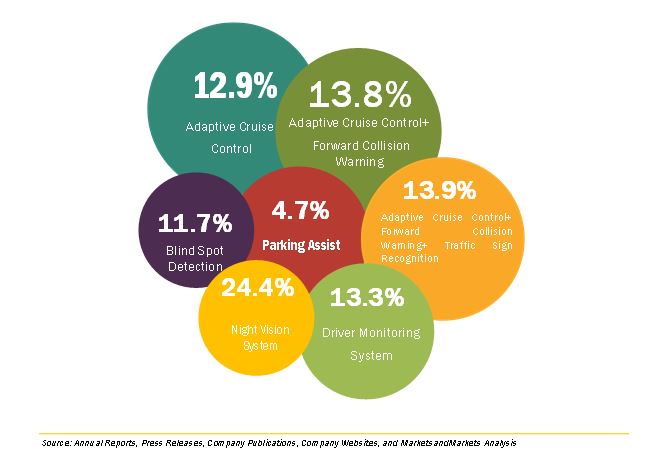

Adaptive Cruise Control (ACC) and ACC+Forward Collision Warning are expected to be the fastest-growing camera applications in electric vehicles. Mercedes-Benz GLC series, Ford F-150 Lightning, Volkswagen ID.5, Citroen C5 X, Ioniq 6, Toyota Harrier PHEV, Mazda CX-60 PHEV, and BMW i7 xDrive 60 are a few of the models offered with the ACC feature.

In electric vehicles, Parking Assist Systems and Blind Spot Detection Systems account for approximately 50% of the overall market. In contrast, Night Vision System is projected to be the fastest-growing segment during the forecast period. However, the specific penetration rate may vary depending on the automaker, vehicle model, and market segment. It’s worth noting that the automotive industry is continuously evolving with new technologies and may have introduced new ADAS features to propel automotive camera sales.

In addition, the automotive camera is gaining traction in electric trucks and buses, which will drive the automotive camera market soon. The ADAS features like pedestrian detection, collision warning, and driver monitoring system will play a pivotal role in the electric bus development, which is anticipated to generate the demand for automotive cameras. According to a study, the electric bus market is projected to amount to USD 678 Bn by the end of 2030, with a growth rate of 14% from 2022 to 2030. This growth is attributed to the shift generated by the emission regulations from national governments. Features like Lane Departure Warning, Automatic Emergency Braking, and Adaptive Cruise Control are the most implemented camera-based solutions in electric commercial vehicles, shaping the automotive camera market in the upcoming years.

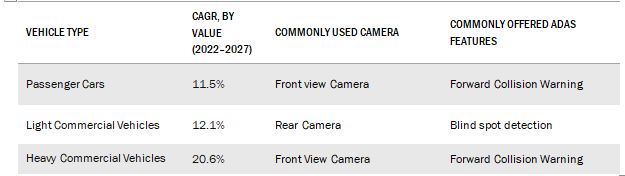

Automotive camera growth rates, 2022–2027

Digital Cameras to lead the Automotive Camera Technologies

The automotive camera market has been segmented based on technology into digital, infrared, and thermal. Digital cameras are used for ADAS applications, such as park assist, lane departure warning, adaptive cruise control, and blind spot detection. These cameras are strategically placed in the vehicle’s front, rear, and side to provide driving and parking assistance. Driver monitoring systems deploy infrared cameras, which use infrared light to detect and analyze the driver’s facial features, such as irritation, happiness, fear, and drowsiness levels. Alternatively, night vision systems use thermal cameras that enhance driving safety in darkness, rain, fog, and snow.

Considering the park assist, lane departure warning, BSD and ACC as the fastest and largest driver assistance systems using cameras, which use digital cameras, digital cameras are projected to lead the automotive camera market.

Increasing penetration of camera-based convenience features in luxury vehicles generates a positive impact on the sales of automotive cameras

Starting at over US$45,000, the luxury vehicle segment includes cars with high-end technologies like automotive cameras, infotainment, information clusters, and more. Premium EVs are being introduced by Jaguar (UK), Mercedes (Germany), Audi (Germany), and Porsche (Germany). Additionally, automakers are working to offer cutting-edge features at affordable costs.

To provide convenient parking solutions, major premium automakers like Audi, Mercedes, Cadillac, and BMW offer convenience features like a surround-view or a 360-degree view. Drivers can maneuver in confined parking spaces with ease. In segments of luxury and premium vehicles, these features are considered standard. Major OEMs are also developing camera-based features, like driver authentication, allowing drivers to customize their cabin settings and driving conditions for a pleasurable experience. These features will initially be used in luxury vehicles. Therefore, it is anticipated that the increased use of camera-based convenience features in luxury vehicles will increase demand for automotive cameras and turn them into a significant source of income for manufacturers.

On the other hand, the introduction of autonomous vehicles will probably encourage the deployment of a few camera systems, and the typical number of cameras in a vehicle will probably rise as the level of autonomy does as well. NXP claims vehicles with Three to six cameras and other sensors would be used with level 3 autonomy. Cellularye, 8g_tJU To address the shortcomings of existing camera-based applications, numerous start-ups are working to enhance the functionality of camera-based solutions. Autonomous vehicles require a variety of sensors, including cameras, radars, and other devices that sense their surroundings, even though the technology is still in its infancy. Autonomous vehicles will significantly alter how fleet operators, providers, and ride-sharing businesses operate. OEMs and camera suppliers will strategically work together to speed up the commercial production of autonomous vehicles, which will further expand the market.

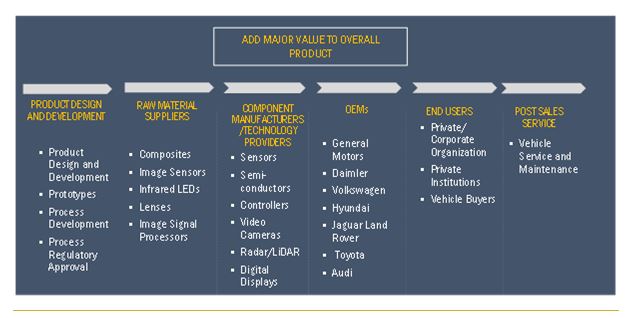

Automotive Camera Market– Supply Chain:

The automotive camera market supply chain comprises several participants, from research and product development executives to end users. OEMs partner with Tier-1 component manufacturers and technology providers to build a strong regional customer base.

The automotive camera market value chain comprises R&D executives, raw material providers, component manufacturers, OEMs, and service providers. Manufacturers often establish partnerships with other retail operators. In a few instances, government organizations across various regions make their key contact points for professional and custom installers.

Figure: Automotive Camera Market: Supply Chain Analysis

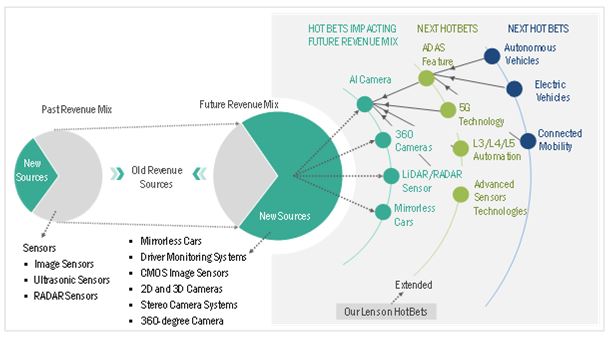

Automotive Camera – Future Revenue Pockets

The automotive camera market is expected to witness a revenue shift in the coming years, from rear cameras with applications of parking assist to ADAS applications and connected mobility. ADAS offer features critical in road safety and mandated by regulatory authorities in different countries, which are expected to play a vital role in the market growth. Besides, developing vehicle-to-vehicle communication infrastructure and connected vehicle technologies will impen the automotive camera market. Connected vehicle technology comprises telematics, infotainment, and combined telematics & infotainment. These technologies enable vehicle access to safety, information, navigation, and remote diagnostics. In the future, with the advent of semi-autonomous and autonomous vehicles, these technologies are estimated to have a wide presence in semi-autonomous and autonomous vehicles. Autonomous vehicles will be constantly connected and communicate with the network of automatic navigation systems and connected car services. Semi-autonomous vehicles can be operated for an extended time with the help of connected devices with little input from the driver.

Credit: marketsandmarkets