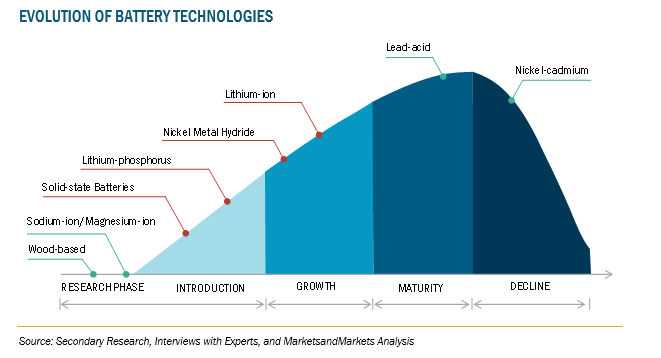

The future of battery technology is set to revolutionize the EV industry, heralding an era of unprecedented efficiency, sustainability, and performance. Electric vehicles predominantly use lithium-ion batteries, with chemistries like NMC, and LFP offering different trade-offs in energy density, cost, and safety. Battery technology is continuously evolving, with high-nickel NMC, cobalt-free, and LFP batteries addressing the demand for better performance and sustainability. Manufacturers supply battery cells, modules, or complete packs to OEMs, who integrate them into vehicles. When batteries can no longer hold sufficient charge, recycling becomes crucial. Recycling processes aim to recover valuable materials like lithium, cobalt, nickel, and manganese to reduce the environmental impact and lower the cost of new batteries. Advancements in recycling technologies are essential to ensure the sustainability of the growing EV market. Emerging battery chemistries such as sodium-ion and solid-state batteries promise faster charging, higher energy densities, and improved safety, representing the future of EV energy storage solutions.

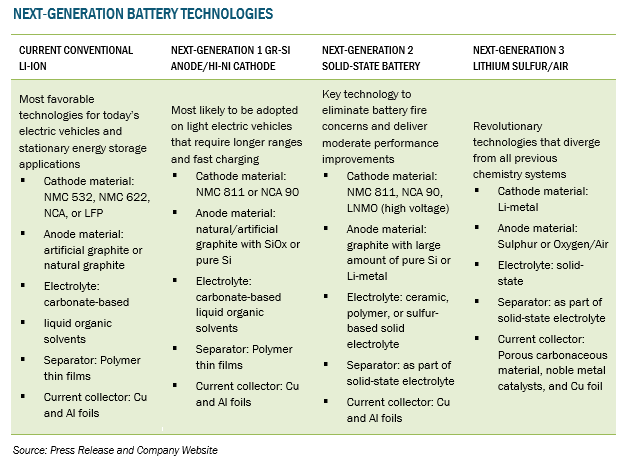

The table below covers some of the new upcoming technologies in the EV battery Ecosystem.  The EV industry has rapidly evolved with ongoing developments in design, features, engineering, and battery technology. Recent advancements in the EV market have resulted in the introduction of batteries with higher standards. While these batteries are expected to improve EV performance and range, factors such as the limited range of EVs, the significant charging time required, the high price of EV batteries, and the limited availability of charging stations make users hesitant to choose EVs over ICE vehicles. As a result, EV battery makers are concentrating on overcoming these challenges by developing new batteries with creative, fast, and rapid charging technologies.

The EV industry has rapidly evolved with ongoing developments in design, features, engineering, and battery technology. Recent advancements in the EV market have resulted in the introduction of batteries with higher standards. While these batteries are expected to improve EV performance and range, factors such as the limited range of EVs, the significant charging time required, the high price of EV batteries, and the limited availability of charging stations make users hesitant to choose EVs over ICE vehicles. As a result, EV battery makers are concentrating on overcoming these challenges by developing new batteries with creative, fast, and rapid charging technologies.

The future of batteries market is dominated by established players such as CATL (China), LG Energy Solution Ltd. (South Korea), BYD Company Ltd. (China), Panasonic Holdings Corporation (Japan), and SK Innovation Co., Ltd. (South Korea) and others. These companies manufacture batteries and develop new technologies. For instance, In July 2023, China’s BYD Company Ltd. (China) proposed a USD 1 billion investment in India to establish manufacturing facilities for electric vehicles and batteries.

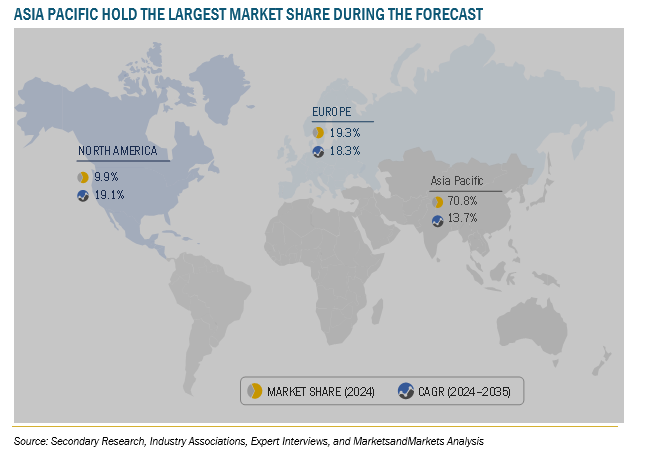

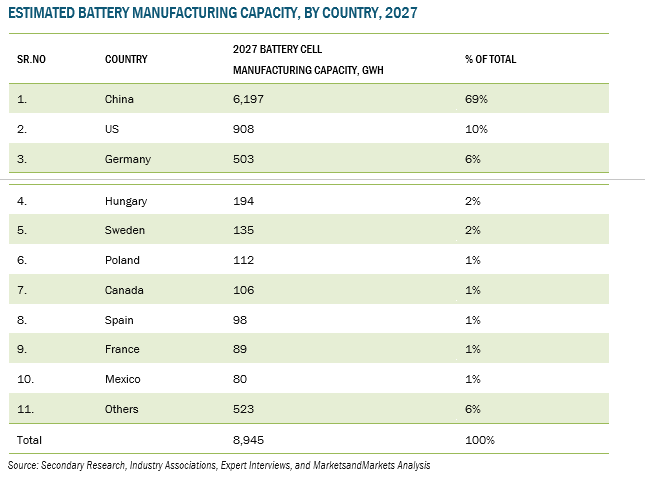

According to MarketsandMarkets, the Future of Batteries market is projected to reach USD 741.17 billion by 2035 starting from USD 179.54 billion in 2024, growing at a CAGR of 13.8%. The market growth is governed by improvements in battery technology and supporting government policies and regulations for electric vehicles. As per Atin Jain, Assistant Manager (Automotive and Transportation domain) at MarketsandMarkets Research, “The EV battery supply chain is to witness disruption with R&D investment for new battery chemistries. China remains dominant in battery production, particularly for LFP and nickel-based chemistries. The limits of the existing lithium-ion battery technology are being addressed by the development of new battery technologies. Sodium-ion batteries are becoming more and more of a viable substitute because of their lower cost and less dependency on vital minerals like cobalt and lithium.

As per Atin Jain, Assistant Manager (Automotive and Transportation domain) at MarketsandMarkets Research, “The EV battery supply chain is to witness disruption with R&D investment for new battery chemistries. China remains dominant in battery production, particularly for LFP and nickel-based chemistries. The limits of the existing lithium-ion battery technology are being addressed by the development of new battery technologies. Sodium-ion batteries are becoming more and more of a viable substitute because of their lower cost and less dependency on vital minerals like cobalt and lithium. KEY DRIVING FACTOR FOR FUTURE OF BATTRIES MARKET

KEY DRIVING FACTOR FOR FUTURE OF BATTRIES MARKET

Advancements in battery technology

Advancements in EV battery technology have spurred significant competition in the automotive industry, enhancing the viability of electric vehicles as mainstream alternatives to traditional cars. Key innovations focus on improving battery chemistry and design to extend vehicle range and reduce charging frequency. Cathode chemistries like NMC and NCA, known for their high energy density due to increased nickel content, dominate the market, while the resurgence of LFP, prized for its cost efficiency and nickel-free composition, reflects shifting market dynamics amidst rising commodity prices. Emerging technologies such as cell-to-pack (CTP) integration and solid-state batteries promise further gains in efficiency, safety, and energy density, driving continued innovation and adoption across the industry. CURRENT STATE AND FUTURE OF BATTERY TECHNOLOGY

CURRENT STATE AND FUTURE OF BATTERY TECHNOLOGY

The market for lithium-ion batteries will see a significant rise due to the growing popularity of electric vehicles in both the passenger cars and commercial vehicle segments. Due to their energy density and potential applications, lithium-ion batteries are currently among the most sought-after technologies. More advancements in the energy density, charging speed, and general safety characteristics of this battery type that support enhanced performance can be anticipated in the next years. Manufacturers are looking at less hazardous lithium-ion battery substitutes with more readily available metals. Among them are solid-state/sodium-ion batteries. Compared to a Li-ion battery that uses a liquid electrolyte solution, a solid-state battery has a higher energy density. It reduces the possibility of an explosion or fire, negating the requirement for safety components and freeing up additional space. It will likely offer space to include more active materials that increase battery capacity.

Manufacturers are looking at less hazardous lithium-ion battery substitutes with more readily available metals. Among them are solid-state/sodium-ion batteries. Compared to a Li-ion battery that uses a liquid electrolyte solution, a solid-state battery has a higher energy density. It reduces the possibility of an explosion or fire, negating the requirement for safety components and freeing up additional space. It will likely offer space to include more active materials that increase battery capacity.

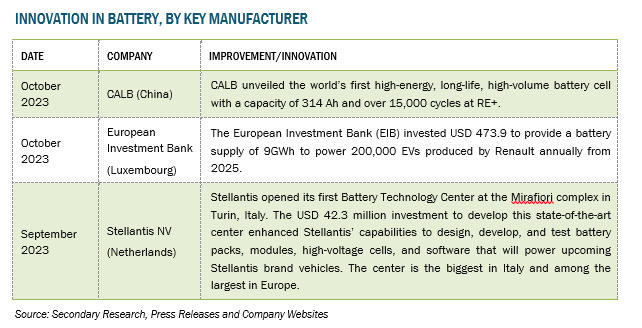

KEY STRATEGIES BY MARKET PLAYERS

CALB unveiled the world’s first high-energy, long-life, high-volume battery cell

Presenting its most recent energy storage systems and products, CALB showcased the world’s first 314Ah high-energy, long-lasting energy storage core together with corresponding solutions that can be produced and delivered in large quantities. The improved battery cell has a longer cycle life of 15,000 cycles since it uses the most recent lithium replenishment technology. This offers consumers a cost-effective energy storage choice. Following a rigorous optimization process, the most recent 314Ah battery cell offers a significant 12% increase in useful capacity over its predecessor, the 280Ah model. Moreover, it attains a 96% energy conversion efficiency. The battery’s cutting-edge material system significantly reduces the amount of active lithium lost during charging and discharging, thereby increasing output efficiency. As a consequence, the battery cell’s capacity does not decrease over the first 1,000 cycles. The batteries exhibit exceptional expandability and provide a versatile customization option at the system level to accommodate the varied energy requirements of different commercial applications.

Subaru and Panasonic Energy agree to cooperate in supply of cylindrical automotive lithium-ion batteries

A basic cooperative agreement pertaining to the supply of cylindrical vehicle lithium-ion batteries has been signed by Subaru Corporation and Panasonic Energy Co., Ltd., a Panasonic Group company. The two companies signed this basic agreement after beginning talks in July 2023 to develop a medium- to long-term collaboration to service the expanding market for automotive batteries and battery electric vehicles (BEVs). By signing this agreement, the two businesses reaffirm their shared commitment to working together to address a range of societal issues, including creating a society that is carbon neutral, encouraging sustainable growth in the automotive and battery industries, assisting in the creation of local jobs, and investing in human resources.

KEY TECHNOLOGY DEVELOPMENT

Lithium-Air

Lithium-air batteries have been proposed as a potential next-generation technology for electric vehicles due to their high energy density. These batteries offer much higher energy densities than traditional lithium-ion batteries, providing longer driving ranges for electric vehicles. The principle behind lithium-air batteries involves the reaction of lithium ions with oxygen from the air, which generates electricity.

Lithium-air batteries have the potential to store more energy than lithium-ion batteries. This could translate to a driving range of several hundred miles for electric vehicles. In February 2023, many electric car owners wished for a battery pack that could power their vehicle for more than a thousand miles on a single charge. Researchers at the Illinois Institute of Technology (IIT) and the US Department of Energy’s (DOE) Argonne National Laboratory have developed a lithium-air battery that could make that dream a reality. The team’s new battery design could also power domestic airplanes and long-haul trucks.

CELL-TO-CHASSIS

The third generation of EV battery packs is a development of the CTP design, called cell-to-chassis (CTC). It is also referred to as cell-to-body and cell-to-vehicle. The primary difference between CTP and CTC is that in CTC, the cells are part of the supporting vehicle structure; they are integrated directly into the vehicle body with other necessary components. Implementing the cells directly into the frame prevents bulky pack-housing, and a large amount of dead weight can be removed. Instead of pack-housing, some filler or adhesive is often used to fix the cells. The CTC trend can be seen as a part of a significant EV design transition where the vehicle frame and cell design are developed together for improved performance at a lower cost. CTC also allows decreased components, high energy density, and reduced cost per kWh from parts and manufacturing.

In December 2023, CATL (China) Integrated Intelligent Chassis fit well with the company’s CTC technology, which integrates main battery components into the vehicle floor, eliminating the need for separate battery packs. This will reduce the initial cost to users and energy consumption, increase the range per charge, and expand passenger space. As CTC technology matures, it has the potential to become the standard for electric vehicles, leading to a new generation of vehicles with excellent range, improved safety, and potentially lower costs.

BY MARKETSANDMARKETS