The transport sector is one of the most significant contributors to GHG emissions globally, owing to which many countries worldwide are focusing on converting the existing fleet of commercial vehicles to zero-emission electric vehicles. With the upcoming government mandates on emissions caused by vehicles, the automotive industry is focusing on efficiency, emission-free propulsion, and innovative technologies. The electric commercial vehicle market is expected to witness significant growth during the forecast period, driven by e-commerce, logistics, delivery and mobility growth. Major R&D activities in electric commercial vehicle focus on to use of energy-efficient electric propulsion, higher vehicle range and innovative battery technologies, which have boosted the demand for electric commercial vehicles. While these vehicles are expected to enhance the performance and range of electric commercial vehicles, factors such as significant charging time, high price, limited life of batteries, and inadequate availability of charging stations make users hesitant to opt for electric commercial vehicles over ICE commercial vehicles.

The use of electric commercial trucks would also greatly benefit logistics companies, whose profits have been steadily declining due to the continually rising fuel prices. Key OEMs such as BYD (China), Mercedes Benz Group AG (Germany), AB Volvo (Sweden), Nikola Motors (US), and Volkswagen AG (Germany) have launched electric commercial vehicles in recent years.

The manufacturers are focused on launch of electric commercial vehicles models. The table below covers a few of the new models launched by key manufacturers.

ELECTRIC COMMERCIAL VEHICLE LAUNCH, BY OEMS, 2022-2023

| MONTH & YEAR | COMPANY | PRODUCT TYPE | PRODUCT NAME | DESCRIPTION |

| March 2023 | BYD | Electric Pickup Truck | Pickup Truck | BYD announced to launch an electric pickup truck in 2023. |

| December-2022 | AB Volvo | Electric Truck | VOLVO FH Electric, VOLVO FM Electric, VOLVO FMX Electric | |

| December 2022 | Tesla, Inc | Electric Truck | Semi | Tesla, Inc officially launched Semi, a heavy-duty electric truck. Semi is currently the only electric commercial vehicle that offers a range of 800 km on a single charge. |

| September-2022 | DAF | Electric Truck | DAF LF Electric | The company launched its electric truck DAF LF powered by LFP batteries with a range of 280 km and a battery capacity of 282 kWh. The truck will be used for light distribution services. |

| September-2022 | Mercedes-Benz Group AG | Electric Truck | eActros Long Haul | Mercedes-Benz Group AG launched its long-range electric truck eActros Long Haul. It is equipped with a battery capacity of 600 kWh, uses LFP battery cells, and has a range of 500 km. |

| February 2022 | BYD | Electric Truck | Q1 | BYD unveiled an electric truck, which offers a 255 kWh lithium iron phosphate battery, a range of 200 km on a single charge, and can reach a top speed of 85 km/h |

Source: Press Release and Company Website

The electric commercial vehicle industry is witnessing technological developments to meet customer demand and be future-ready. Electric commercial vehicle have a lower operating cost than conventional commercial vehicles. Increasing crude oil prices and the need for eco-friendly mobility alternatives are opening opportunities for the market. Electric commercial vehicles have low operating cost relative to ICE commercial vehicles and a sustainable means of transportation. They can leverage existing and future mainstream electric vehicle charging infrastructures. Governing bodies have launched initiatives to build charging facilities. The schemes are funded with huge budgets, focused on promoting electric commercial vehicle through subsidies.

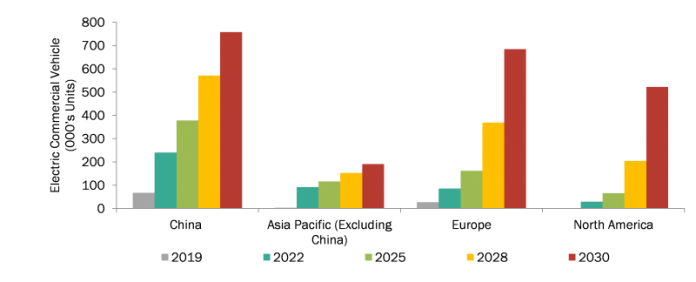

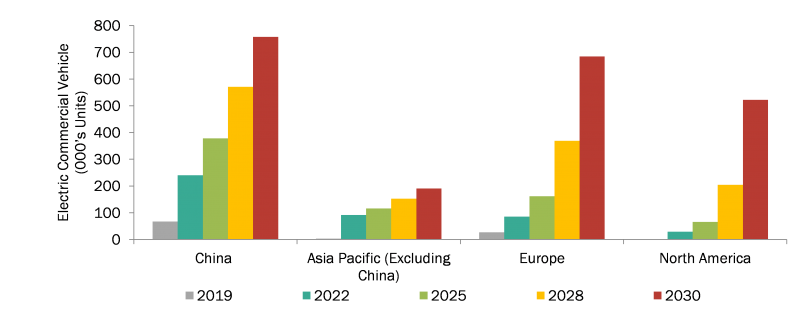

CHINA VS GLOBAL ELECTRIC COMMERCIAL VEHICLE SALES, 2019-2030

As per Atin Jain, Team Lead (Automotive and Transportation) at MarketsandMarkets Research, “The electric commercial vehicle market is growing rapidly, driven by factors such as excessive emissions by fossil fuel-powered commercial vehicles, fluctuations in fuel prices, and government subsidies, incentives and favorable policies. Continuous improvements in charging infrastructures have also led to adoption of electric commercial vehicles across the globe. R&D activities are being carried out to improve battery technology, reduce battery cost, reduce charge time and increase vehicle range. With countries worldwide setting targets to reduce their vehicle emissions, the demand for low-emission vehicles, including electric vehicles, is growing. The electric commercial vehicle market is expected to grow.”

INCREASING DEMAND FOR EFFICIENT AND EMISSION-FREE COMMUTES TO DRIVE MARKET GROWTH

According to MarketsandMarkets research, the global electric commercial vehicle market is projected to reach 2,155.1 thousand units by 2030, starting from 519.4 thousand units in 2023, growing at a CAGR of 22.5%. The market growth is governed by improved battery technology, supporting government policies and regulations, and the consistent launch of new electric commercial vehicle models.

According to MarketsandMarkets research, the global electric commercial vehicle market is projected to reach 2,155.1 thousand units by 2030, starting from 519.4 thousand units in 2023, growing at a CAGR of 22.5%. The market growth is governed by improved battery technology, supporting government policies and regulations, and the consistent launch of new electric commercial vehicle models.

PURCHASE ORDER/SUPPLY CONTRACT FOR ELECTRIC COMMERCIAL VEHICLES

| MONTH/YEAR | PURCHASE ORDER/SUPPLY CONTRACT |

| February 2023 | Ford Motor Company (US) announced winning the US Postal Service contract to supply 9,250 E-Transits as electric mail vans. |

| October 2022 | AB Volvo (Sweden) announced supplying 20 VOLVO FH electric trucks to Amazon (US) in Germany for delivery. |

| October 2022 | Performance Team announced deploying Class 8 battery-electric trucks from Volvo Trucks North America in Southern California in response to customer demand for sustainable short-haul warehouse and distribution center operations. |

| October 2022 | Electric truck rental company Sixt (Germany) announced purchasing 100,000 electric vehicles from BYD (China) through 2028. Sixt will deploy the vehicles to Germany, France, the Netherlands, and the UK. |

| October 2022 | PepsiCo (US) announced the delivery of 100 electric truck Semi to be used in its fleet for delivery purposes. |

Source: Secondary Research, Company Websites, EV Associations, and Country-level Automotive Organizations

KEY DRIVING FACTOR FOR THE ELECTRIC COMMERCIAL VEHICLE MARKET

- GOVERNMENT INCENTIVES AND SUBSIDIES

Various governments have launched attractive initiatives and schemes to facilitate the adoption of electric commercial vehicles. In developed countries, governments have begun the use of electric commercial vehicles, such as vans and trucks. The UK has set a target for new cars and vans to be zero-emission by 2035 and is offering grants and tax incentives to encourage the adoption of electric vehicles. Likewise, Canada has mandated all new passenger vehicles sold in the country to be zero-emission by 2035. It is investing in charging infrastructure and offering incentives to support the adoption of electric vehicles. Governments are also promoting electric trucks to reduce pollution attributed to diesel engine trucks. For instance, Ontario, Canada’s largest province, has introduced a new rebate program for buyers of Tesla’s semi-electric truck, promising up to 60%, or nearly USD 59,000, of the incremental purchase cost of electric trucks. Emerging economies, such as China and India, also plan to introduce zero-emission commercial vehicles in the near future.

- TABLE 1 RECENT GOVERNMENT INITIATIVES TO BOOST THE DEMAND FOR ELECTRIC COMMERCIAL VEHICLES

| Country | Announcement/Policies to Support the Demand for EV/ECVs |

| Germany | The German government is investing Euro 500 million in expanding the country’s charging infrastructure for electric trucks and buses. The goal is to have 1,000 publicly accessible fast-charging stations for commercial vehicles by the end of 2023. Germany set up a USD 145 billion package for infrastructure development, tax reductions, and other subsidies to achieve its 10 million EVs goal by 2030. It has also invested USD 2 billion in hydrogen-based infrastructure development. |

| China | In June 2023, the Chinese government announced a substantial tax incentive package of 520 billion yuan (~USD 72 billion) over the next four years. Under this extended policy, New Energy Vehicles (NEVs) that are purchased in 2024 and 2025 will be eligible for a complete exemption from purchase tax (a maximum of 30,000 yuan (~USD 4,150) per vehicle). For 2026 & 2027, this exemption will be reduced by half (5,000 yuan (~USD 2,000)). This extension is expected to not only boost the sale of electric vehicles but also expected to boost the Chinese economy after the pandemic. |

| US | Consumers in the US currently receive approximately USD 7,500 as tax credits for the purchase of an all-electric or plug-in hybrid electric vehicle. This incentive will be phased out once an automaker sells over 200,000 EVs.

California launched the Clean Vehicle Rebate Project. The project includes rebate funding for low-income consumers and rebates for the purchase or lease of EVs. The City of Toronto announced converting 50% of its fleets into EVs. A considerable part of them will be for long-distance travel and use FCEVs. |

Source: Secondary Research, MarketsandMarkets Analysis

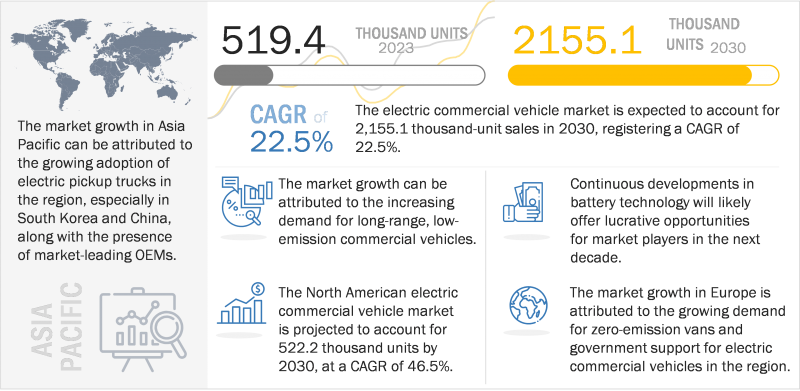

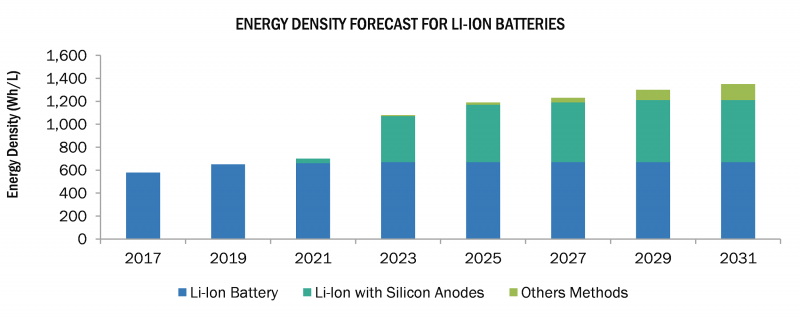

- ADVANCEMENTS IN BATTERY TECHNOLOGY

The battery is a significant component in an electric commercial vehicle. Technological advances in batteries, especially regarding their charge density, making them extractable and more competitive, are the focus of the electric commercial vehicle segment’s leading research and development efforts worldwide. Currently, companies are providing multiple charging options that include a portable charger that can be used to charge vehicles in public places. Besides, charging stations are also installed at homes for convenience. Several companies in EV battery technology have made substantial improvements. For instance, in June 2022, CATL unveiled its Qilin Battery, the third generation of its CTP (cell-to-pack) technology. The battery delivers a range of 1,000 km, has an energy density of up to 255 Wh/kg, and is expected to be mass-produced in 2023. Such ongoing developments in the field of EV batteries are targeted towards improving the range of electric commercial vehicles, with most major EV battery manufacturers innovating in the battery design and chemistry to extend the range of EVs to eliminate the requirement for regular charging.

AVERAGE ENERGY DENSITY (Wh/L) OF LI-ON BATTERIES, 2017–2031

KEY TARGET BY MARKET PLAYERS

- RIVIAN ANNOUNCED TO INCREASE PRODUCTION CAPACITY TO 1 MILLION UNIT/YEAR by 2030

Rivian successfully launched its IPO and now has almost USD 12 billion (on top of USD 10.5 billion raised previously) to expand its EV business. The company wants to grow quickly and reach a volume of at least 1 million electric vehicles per year by 2030. The long-term plan for Rivian is to have a total of four assembly plants around the world, including one additional factory in the U.S. and probably one in Europe and one in China. The second factory in the U.S is expected to also produce in-house developed battery cells (potentially in-house developed). In February 2022, the company shared ambitious plans to acquire 10% of the EV market by 2030.

- GENERAL MOTORS ANNOUNCED ITS AMBITIOUS EV GOALS

General Motors became the first conventional car company to pledge to sell only zero-emission cars and trucks by 2035. GM has committed to invest USD 35 billion in its transition to selling only EVs by 2035, and is aiming for carbon neutrality by 2040. About 50% of the U.S. production will be converted to EVs by 2025, and has announced four battery plants in the U.S. The company has also partenered with Pilot and Flying J will accelerate the expansion of charging infrastructure and enable long-distance electric travel via a network of 2,000 chargers.

- TESLA ANNOUNCED TO BUILD ROBOTAXI BY 2024

In April 2022 the company plans to build a dedicated robotaxi by 2024. The robotaxi will be a self-driving vehicle that will not have a steering wheel or pedals. The company announced that the robotaxi will be “highly optimized for autonomy” and that it could potentially cost less than a bus or subway ticket. Tesla, Inc is not the only company that is working on robotaxis. Other companies that are developing robotaxis include Waymo, Uber, and Lyft. However, Tesla, Inc is one of the leading companies in the field of self-driving technology, and it has the potential to be a major player in the robotaxi market.

Disclaimer: MarketsandMarkets™ provides strategic analysis services to a select group of customers in response to orders. Our customers acknowledge when ordering that these strategic analysis services are solely for internal use and not for general publication or disclosure to any third party.

MarketsandMarkets™ does not endorse any vendor, product, or service profiled in its publications. MarketsandMarkets’™ strategic analysis constitutes estimations and projections based on secondary and primary research and is therefore subject to variations.

MarketsandMarkets™ disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness, for any particular purpose.

MarketsandMarkets™ takes no responsibility for incorrect information supplied to it by manufacturers or users.

Trademarks, copyrights, and other forms of intellectual property belong to MarketsandMarkets™ or their respective owners and are protected by law. Under no circumstance may any of these be reproduced, copied, or circulated in any form without the prior written approval of MarketsandMarkets™ or its owner—as the case may be.

No part of this strategic analysis service may be given, lent, resold, or disclosed to any third party without express permission from MarketsandMarkets™.

Reproduction and/or transmission in any form and by any means, including photocopying, mechanical, electronic, recording, or otherwise, without the permission of MarketsandMarkets™, is prohibited.

For information regarding permission, contact:

Tel: 1-888-600-6441